What is the IG Client Sentiment Index?

The IG Client Sentiment Index or IG Client Sentiment Report is a free-to-use sentiment indicator observing the client positioning of IG across several popular derivatives.

In any traded market analysis, sentiment refers to how participants feel about the prices of a specific asset, whether optimistic/bullish, pessimistic/bearish, or neutral.

Investors form their prevailing bias due to many technical factors, fundamental factors, and general crowd psychology. Several indexes exist for gauging sentiment, meaning you don’t need to be bogged down too much into what causes investors to feel a certain way.

However, client positioning data is the simplest to interpret and access. The IG Client Sentiment Report is one of the most commonly used in this regard, especially in forex, and because of IG’s enduring popularity in the derivatives industry.

The broker offers actual data on the percentage of its clients who have long and short positions on many markets, mostly in forex, but also in a few indices and commodities. One defining feature of many sentiment reports is their contrarian nature, and the IG sentiment indicator is no exception.

Why is this sentiment index a contrarian indicator?

As you become familiar with this tool, you’ll realize something strange. It’s natural to assume that if most traders have buy orders on an instrument, the bias should be bullish. Interestingly, this is mainly in reverse with the IG Client Sentiment Indicator.

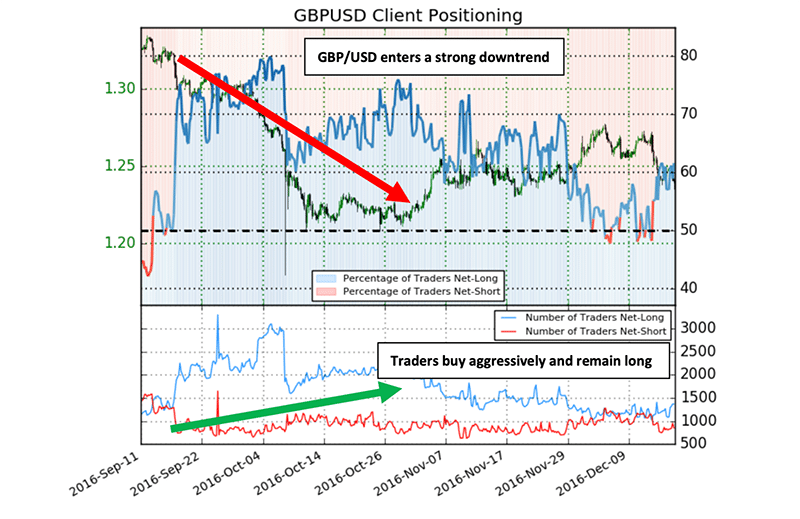

There are two reasons why most sentiment tools are viewed in a contrarian manner. The main one is the tendency for many retail traders to ‘pick tops and bottoms.’ In other words, such groups take sell orders in bullish markets or buy orders in bearish markets.

There’s a perception that institutional traders influence most trends. Therefore, if this group is still holding their positions, everyone else will follow suit, causing the market to continue in one direction.

The second reason extends from this primary factor, related to stop loss orders. If the price moves against a losing trader, their stop losses simultaneously close their order with a loss while creating an order for another trader to enter the market.

In simpler terms, a stop loss from a sell order means an order to buy at that level (as you need a buyer for every seller or a seller for every buyer), which would push prices even higher. The opposite is true for stop losses in buy orders.

How to interpret the IG Client Sentiment Indicator

Changes to the IG Client Sentiment Indicator data are updated daily, typically between 09h00 to 11h00 UTC.

The first part of this index is an overview of all the instruments covered where you can observe the overall trading bias for each, the percentage of net-long (buyers) and net-short (sellers), and changes to the longs and shorts over the last day and week.

You can scroll down to view a more detailed overview of your preferred markets. Here is an example below:

Of course, the most crucial part to peruse is the resulting bias: bullish, bearish, or mixed. When bullish, you should be looking for buying opportunities; when bearish, you should be looking for selling opportunities.

If the bias is mixed, you may want to not look for any positions in that particular asset until things change.

Methods of using the IG Client Sentiment Indicator

The IG Client Sentiment Indicator helps confirm a long-term trend and instances where it might be changing. Let’s explore both concepts with recent real-life examples.

Trend confirmation and continuation

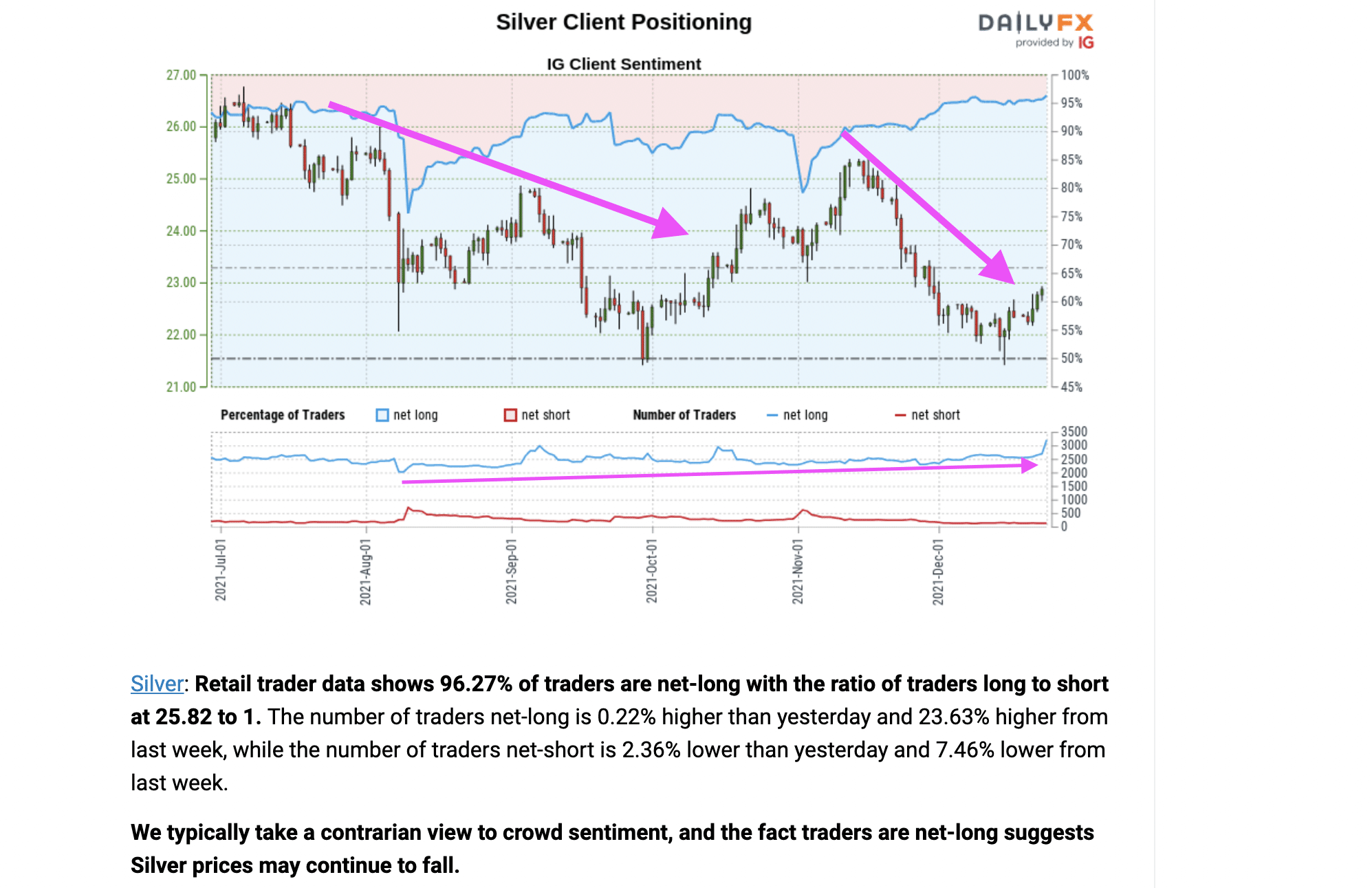

Several traders can struggle with confirming the prevailing trend in a particular instrument. Fortunately, this is where this tool excels. In the scenarios below, we’ve traced the directions of the XAGUSD, or silver, market along with the graph of net-long clients.

Presently, data suggests almost 97% of traders have buy orders. Due to the contrarian nature of the index, we can see a bearish trend, which is further confirmed by the price action.

Trend changes

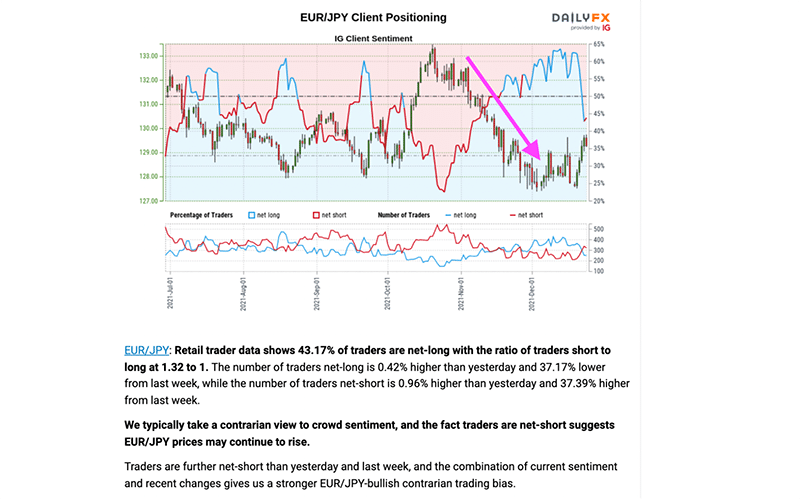

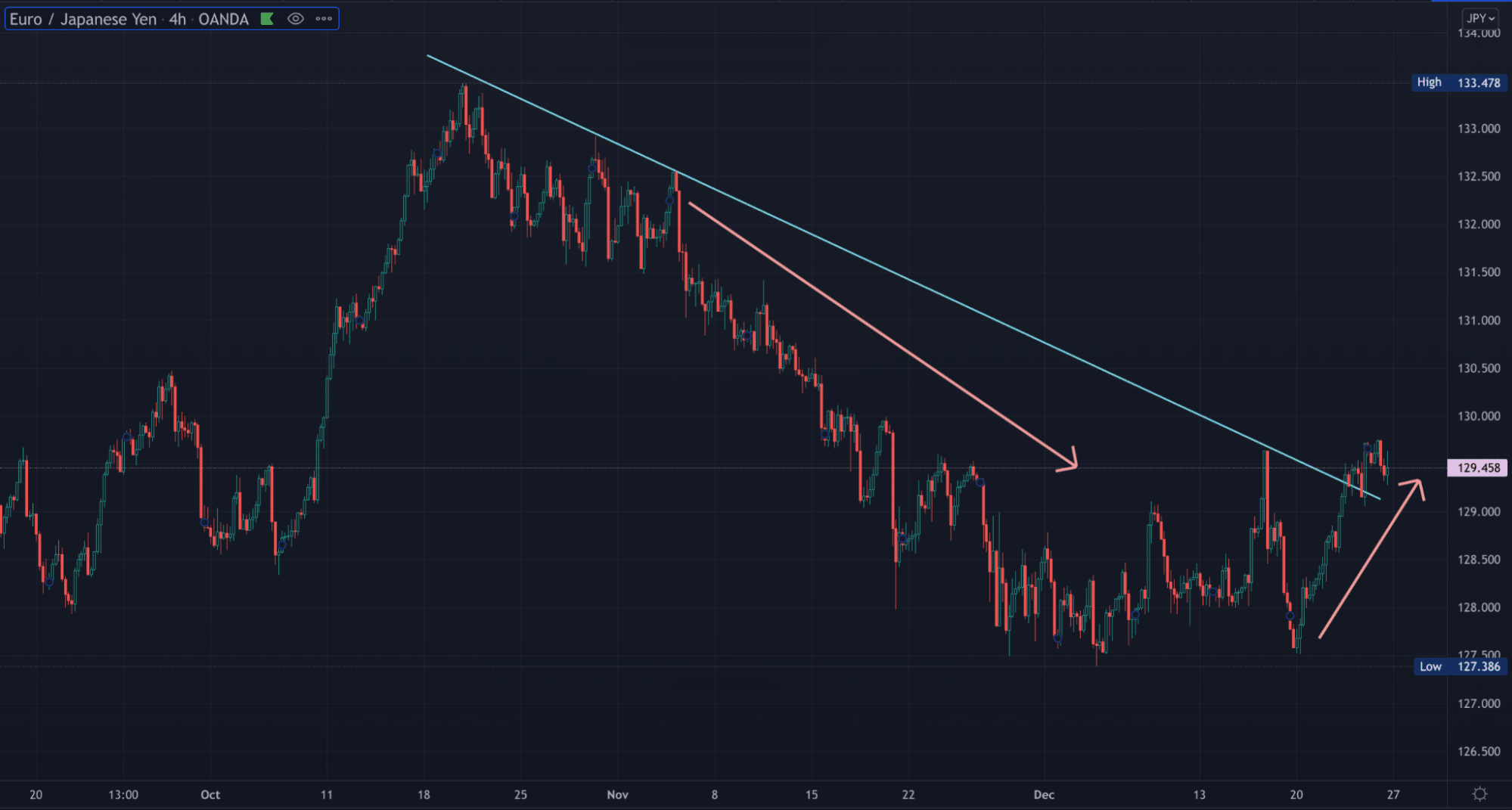

In the image below, IG describes the changes between buyers and sellers on EURJPY.

This pair was in a sustained downtrend for about two months. IG mentioned in their report for EURJPY that the number of net-short clients was 37.39% higher than the last week, while the number of net-long clients was 37.17% lower within the same period.

As confirmed by the report, the sentiment was likely to become bullish with more sell than buy orders. Moreover, we’ve drawn a trendline break in the chart if traders needed extra confirmation to look for buying opportunities going forward.

This demonstrates how you can combine sentiment data with other analytical concepts to form a reasonable trading bias.

Pros and cons of using the IG Client Sentiment Indicator

The IG sentiment indicator isn’t a holy grail like any other trading tool. Let’s cover the main benefits and drawbacks.

Pros:

- This sentiment indicator is free of charge, and one doesn’t need to have an account with IG to use it. Moreover, it’s pretty simple to interpret considering the amount of data present.

- While the IG Client Sentiment Index is not necessarily a leading indicator, it provides valuable insights with actual predictive capabilities. We can pinpoint the origin of many present market trends by studying this tool.

Cons:

- Sadly, since most derivatives offered through brokers are decentralized or non-exchange traded, data from the IG Client Sentiment Report is only limited to the number of clients trading with IG (reportedly around half a million) instead of entire markets.

Yet, this limitation hasn’t severely reduced the predictive level of this tool as the indicator is fairly accurate, particularly when observing long-term trends.

- The bummer worth noting is the IG sentiment indicator updates daily, meaning it’s not real-time. As with any concept, sentiment can frequently change even throughout the day. Therefore, it’s best to utilize this report if you’re interested in long-term movements rather than short-term ones.

Conclusion

The typical school of thought for making trading decisions is using a combination of technical and fundamental analysis. While these methodologies are helpful, sentiment analysis is often overlooked yet could be a valuable addition to any trader’s ‘arsenal.’

Unlike the previously mentioned analysis strands, sentiment is based on real, actionable data. Yet, as with any tool, traders should use the IG Client Sentiment Indicator as a confirmation layer combined with other setup triggers to form a trading idea.

Furthermore, you must be aware of the limitations of this index.