Mr. Martin is a fully automated expert advisor that uses multiple balance protection parameters for using grid and martingale strategies. It works on EURUSD with a minimum deposit requirement of $1000. All the positions are opened when the candlestick closes on the chart. Let us go through the critical characteristics of the system to see if it can be profitable for us to use.

Product offering

The seller shares all the information on the MQL5 website. They miss out on sharing important details such as the input parameters and the detailed statement for the backtesting records. We have to scan and search the website for potential knowledge.

Vendor transparency

Vasiliy Kolesov, located in Russia, is the author of the EA. He has a total rating of 5 based on nine reviews. The developer has 11 products published on the MQL5 marketplace: EA Monolith, Yellow Mouse, and others. According to the MQL5, he has more than five years of experience in the market, but there are no certificates that could verify this.

Price

Traders can get the EA for $360 that gives license for a single account on the terminal. There are no renting options present for now.

Trading strategy

The robot works on EURUSD and opens trades when the bar closes on the M1 timeframe. It uses averaging strategies, deposit protection and several other filters to ensure that the drawdown does not exceed a certain value. To make the robot function properly, a hedging account is necessary.

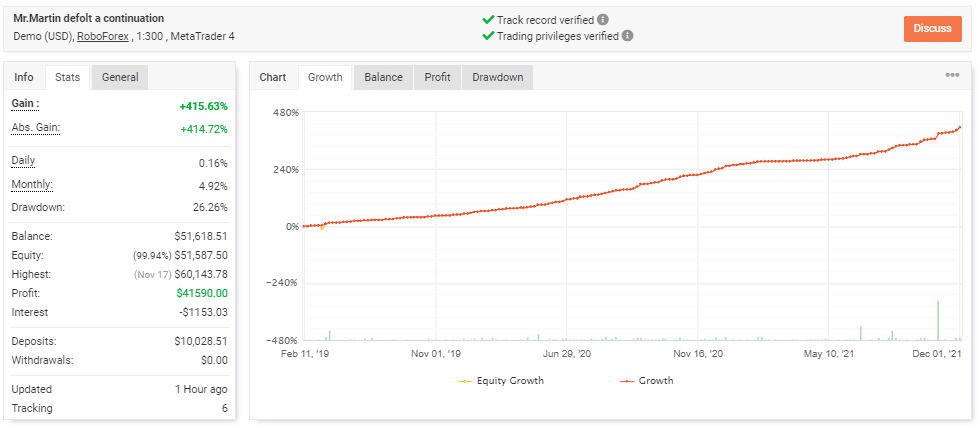

From the history, at the Myfxbook records, we can observe the implementation of martingale in addition to the grid. It can increase the lot size aggressively after a certain trade moves into a loss.

Trading results

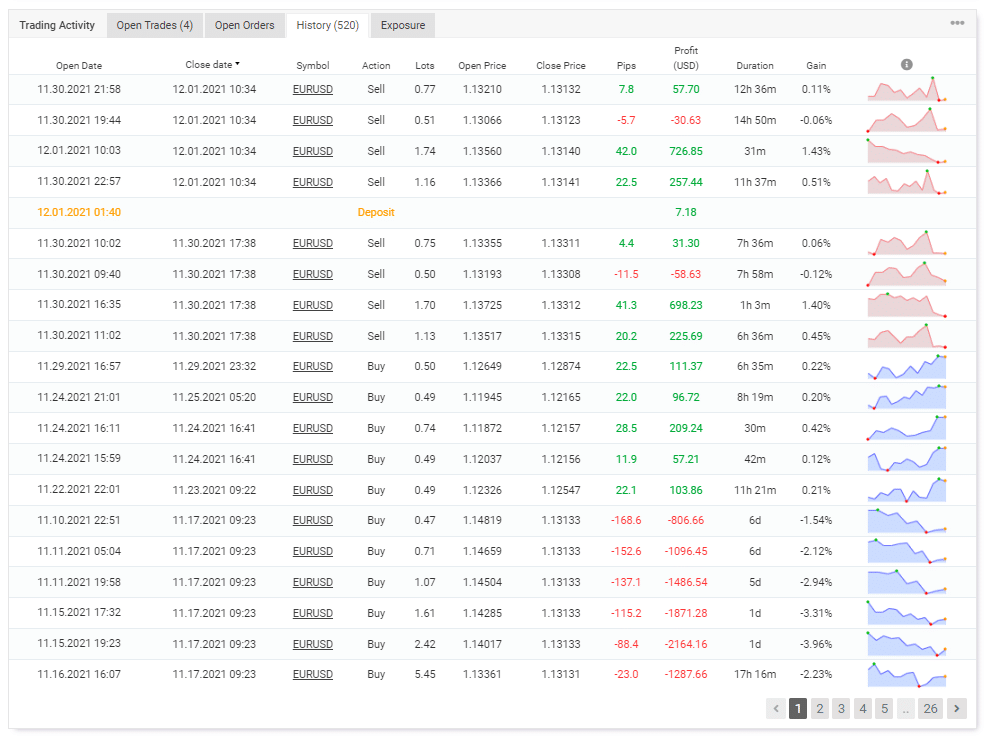

Backtesting results are available for EURUSD on the M15 chart, where the relative drawdown was around 28.17%. The winning rate was 74.17%, with a profit factor of about 2.75. With a starting balance of $750, the robot tanked an average profit of $5919.49 in 4 years.

There were 689 trades in total in which the best trade was $269.11, while the worst one was -$192.63.

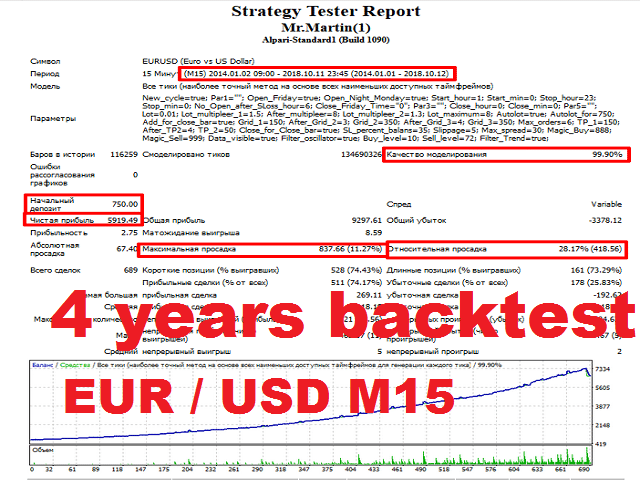

We can see the trading records on Myfxbook. The algorithm has been trading from February 11 2019 till the current date.

The system has made an average monthly gain of around 4.92%, with a drawdown of 26.26%. The winning rate stood at 72%, with a 2.47 profit factor. A high value of the downside gives us a poor risk-reward ratio. It shows that the system has to risk $5 on the line for making a single dollar.

The best trade was $13308.71, while the worst one was -$2306.05, in a total of 508 trades. The developer made a $10028 deposit on a demo account and used total leverage of 1:300.

The average trade duration is one day. Virtual portfolios are not a good way to show the performance of robots. It shows that developers are not ready to risk real money.

Customer reviews

There are eight reviews present at the MQL5 marketplace giving the system a total of 4 stars. One of the traders states that the robot is not being updated thoroughly.