Opening range breakout is a trading technique that makes use of breakouts, in which traders gain confidence in the direction of a market once the market’s initial price range has been broken.

The opening range breakout strategy is used by traders to attempt to lock in gains as soon as possible by initiating long and short positions as soon as the market opens up for business. Bulls will initiate long bets, and bears will exit short-sell trades as soon as they are able.

The opening range is determined after some time. As a result, the breakout will serve as a trend trigger, defining the trend for the remainder of the trading day. In the event that a trend begins to emerge, it will most likely follow the path of least resistance that was established by the breakout.

How to find the correct range to open

When trading sessions begin, opening ranges are areas where prices move for a certain period of time. Depending on how long it takes to create, it can take from just a few minutes to an hour. The only problem is that time and moment are completely relative.

Traders typically use opening price ranges to identify the mood of the market and the direction a pair or index will go. It illustrates the high and low prices for the specified time period. The breakout is the ultimate trigger to enter the market.

Traders think about time differently and prefer to trade on the basis of what’s most convenient for them. To best determine your framework, practice with a demo account for the appropriate amount of time, and see what time frame provides the best trading results for your style.

Strategies

Gap reversal

Forex pairs have trading ranges that go up and down. These are also known as gaps. When the gap opens up in the same direction as the price movement, traders attempt to enter the market in the opposite direction of the price movement.

When the price gap widens to the downside, and the price falls below the bottom of the starting range, you will have discovered a reversal. In a bearish gap reversal, on the other hand, the range high is broken on the upside.

Another thing to keep in mind is that the profit target is based on the gap’s high and low. Adding a stop loss near the middle of the trading range would be beneficial.

Gap pullback

When the pair reverts to the previous close price in the middle of a gap, it is a buy or sell pullback.

Following a breach above or below the opening range, the price advances along the line of the opening to complete the breakout.

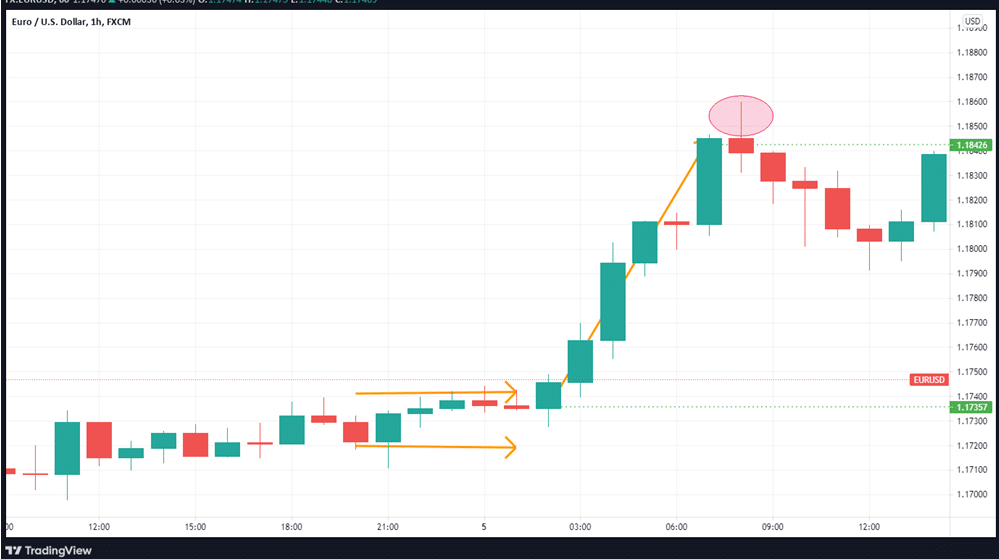

Stop-loss orders should be placed below the low of the range (see the orange arrows) or the low of the first candle that starts the breakout (the first candle that closed above the upper orange arrow). To calculate the minimum profit target, add the height of the range to the upper border of the range (in case of a bullish breakout).

On November 5th, 2020, the EURUSD opened below the previous close, which was a bearish signal. However, the uptrend was re-established, and the pair went on to break above 1.1735 thereafter.

Under these conditions, the pair would experience a 109-pip move from the breakout to the resistance area near 1.1842.

Early morning breakouts

Early morning breakout trading has a higher success rate than the opening range breakout strategy. It is proportional to the size of the gap created when the pair breaks out. With this strategy, when you’ve found the opening range, open your position with a bias toward the current trend.

It is safe to say that the profit target is no more than the distance between the opening range low and high.

Nevertheless, you should go back to reevaluate your strategy before closing the position because this allows you to reap the benefits of your wins if the conditions allow.

You should place stop losses about halfway between the opening range high and low.

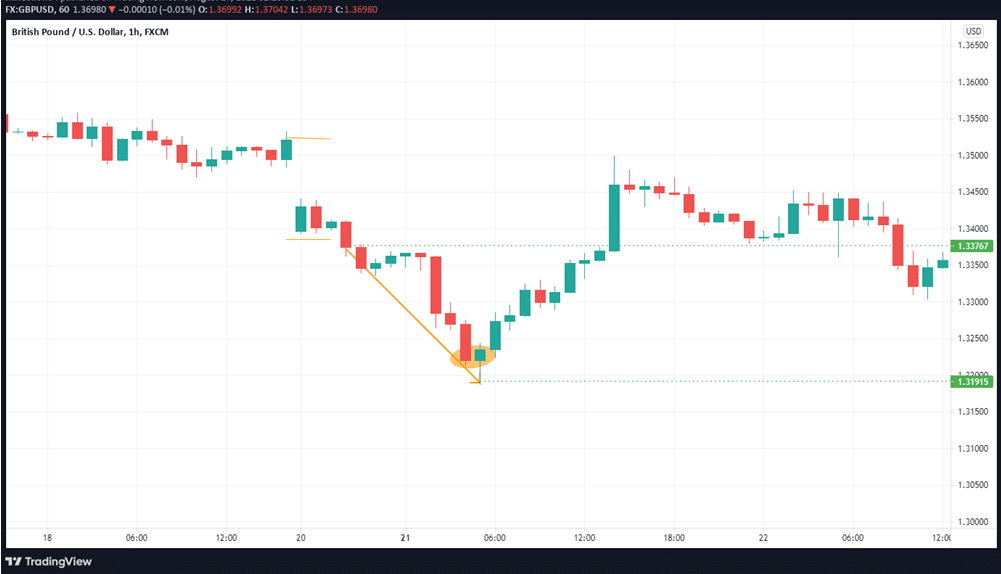

The British pound US dollar opened with a significant bearish gap from its previous Friday’s close on December 18, 2020, in the sample above. If you use a 1-hour chart, you can quickly identify the opening range and then go short.

From Friday’s close to Monday’s opening, the profit-taking level is near 1.3191, the support level. You would gain 182 pips if you closed the position based on the key support.

Advantages and disadvantages

In the market, there are no guarantees. You are granted the opportunity to succeed, but you also risk experiencing losses.

Pros

- The breakout strategy’s opening range success rate is high. It is applicable in any time duration and especially in timeframes of less than a month.

- It can be used as a strategy for reacting to the release of an economic indicator.

- You are trading against the current trend, but keep in mind that the current trend is always on your side.

- Other technical indicators are complemented by this indicator to increase the win rate.

Cons

- It’s susceptible to false breakouts due to opening market conditions, and volatility can be high.

- It has a low success rate in choppy markets.

In summary

Identifying the opening range breakout and executing it can lead to profitable trades. For certain times during trading sessions, however, this strategy has limitations. It takes experience to distinguish the real breakouts from false ones.