Pipbreaker is marketed as the most effective way to trade manually and safely as it is the best indicator for MT4/MT5. It is also alleged that it has a 93% higher success ratio than the failure ratio. However, we have learned that these are just marketing gimmicks.

Product offering

The presentation of Pipbreaker on its official website is simple. The vendor uses the platform to introduce the public to its various products and signals, blog, profile, contact info & FAQ.

Pipbreaker is the work of Wetalktrader. This is a US-based company that has been creating and selling trading market products. Its activities and achievements in the market can be traced back to 2009. Unfortunately, the “About Us” page doesn’t mention anything else that could help us know or understand the qualifications of the team behind the indicator.

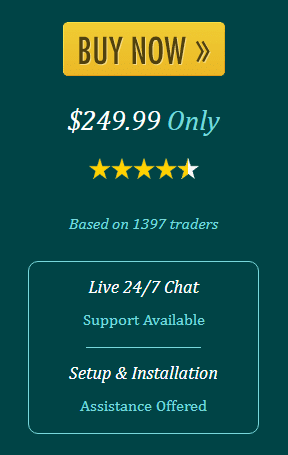

Pipbreaker is currently going for $249.99. This cost is outrageous for an indicator. This kind of pricing may be more acceptable for Forex EAs. A money-back guarantee is not featured.

Trading strategy

The real trading tactic used is not disclosed. The vendor only says that while using the indicator, the trader can select the trading style they desire including scalping, long term or short term approaches. However, the team should have told us which tactics attract the best outcomes. That way, they would have convinced us that they have the trader’s best interest at heart.

The features of the indicators are listed below:

- It offers signals on all currency pairs but a majority of the signals cover all USD pairs, EUR pairs and all other main symbols.

- The design is user friendly as it is easy to comprehend-green arrow for BUY and Red allow for SELL.

- Works on all kinds of trading styles.

- Allows the trader to introduce proper stop loss for every trade.

- Friendly customer support.

Trading results

Backtest results are missing. The vendor has attached little importance to this data. Clearly, they do not think traders need to know how their signals performed in the past. Trading results are also unavailable on the official website. Therefore, we visited Myfxbook.com and searched for them. As luck would have it, we found statistics for a demo account and we have assessed them as follows:

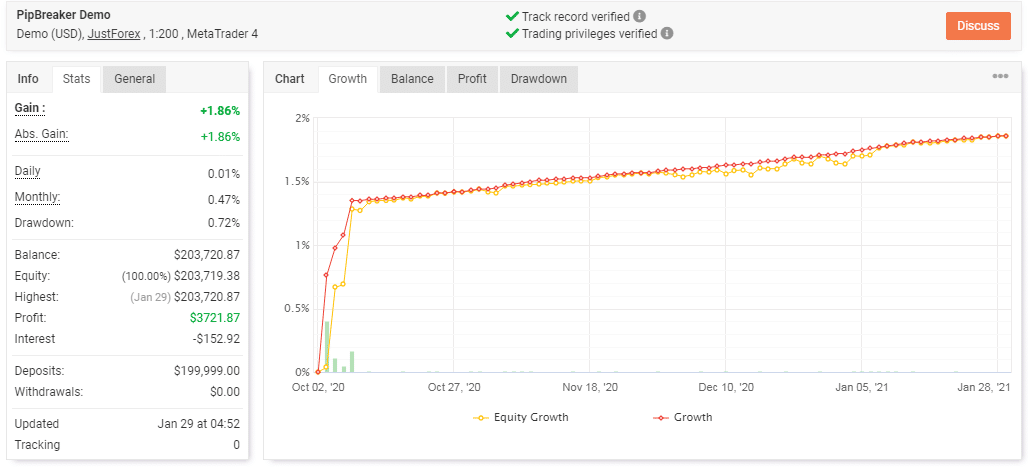

The trading stats above indicate that the demo account is no longer active. It only traded for about 3 months, i.e., between October 2020 and January 2021. For the short time we can see that the signal was not productive as it only generated a gain of 1.86% and monthly profits of 0.47%. From a whopping deposit of $199,999, a meager profit ($3,721.87) was made. So, the balance increased slightly to reach $203,720.87. The drawdown was 0.72%.

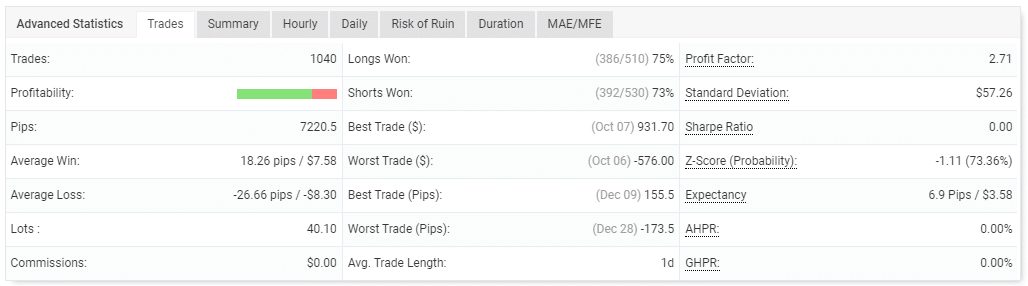

Many trades were completed at the time, 1040 to be precise. The average win was 18.26 pips. The average loss was way more — 26.66 pips. What we can gather from this data is that the indicator failed to make adequate wins and mainly ended up with losing positions instead. The profit factor was 2.71. The performance of long (75%) and short (73%) positions also brought to our attention the low profitability rate of the account.

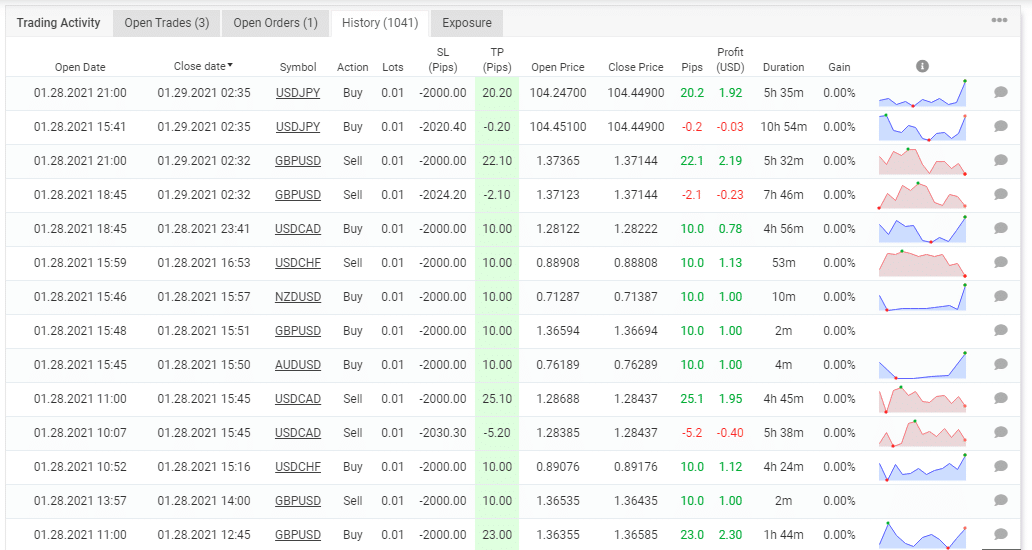

Take profits were applied, and the trailing stop losses were large, e.g., -2000. The grid strategy was present. No gains were made.

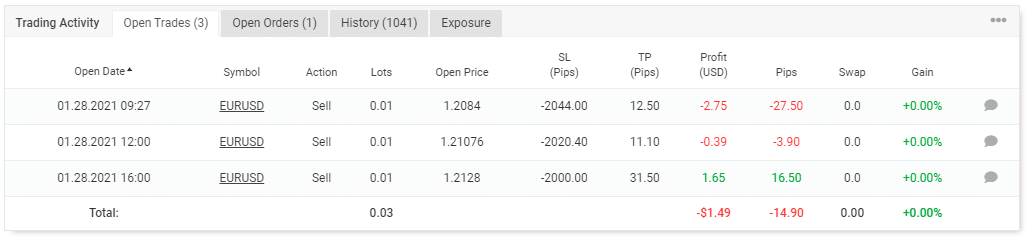

The EURUSD currency pair did not perform well at all. The signals offered only led to one profitable occasion.

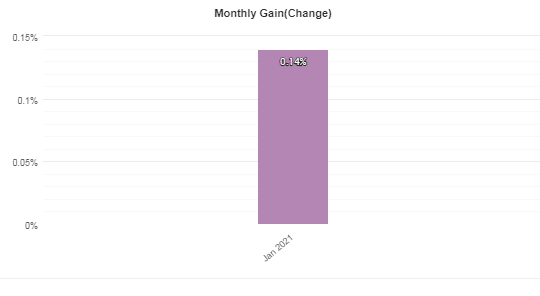

Only 0.14% profits were made in January.

Customer reviews

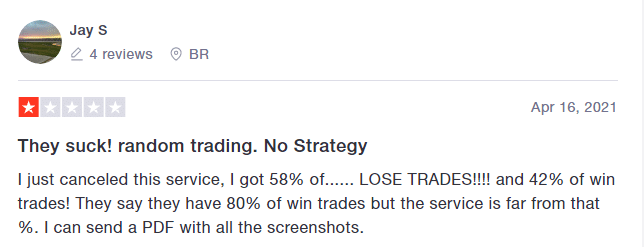

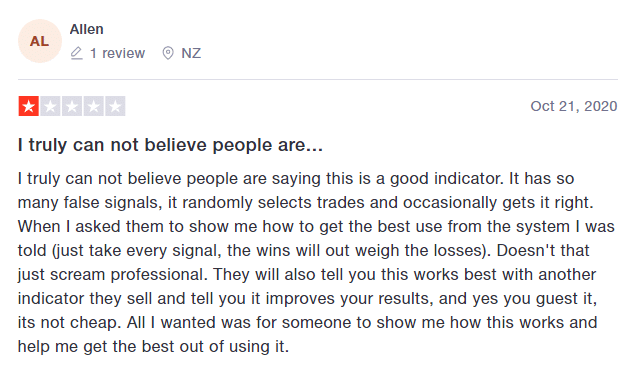

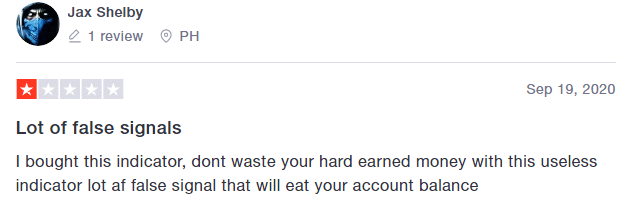

Many clients praise the product on its official site but we have chosen to ignore them because we doubt their validity. Even though we could not find any specific feedback on this indicator on Trustpilot or FPA, both platforms have created a page for the Wetalktrader Company.

A significant number of traders have discredited the firm’s credibility. We have paid special attention to the feedback on Trustpilot. Among customers who have provided negative feedback, one thing is clear; the indicators offered by the vendor use no particular strategy and most of the signals provided are false.