Prop Firm EA is an FX robot that promises a drawdown of less than 4.20%. This FX EA claims to be capable of tackling the funding firm challenges. It uses a fully automated trade setup that is easy to understand with the help of the user guide. This EA trades on 20 currency pairs and boasts trading results verified by the myfxbook site. A monthly profit of 10% to 20% is assured by the vendor and the EA is compatible with MyForex Funds, FTMO, and other funding firms.

Product offering

My EA Academy promotes this FX EA. The company is registered under the name, SinryAdvice Worldwide. A register number, email address, and social media links are found on the Contact Us section of the website. But we could not find info on the founding year, the location address, etc. The vendor does not provide info on the developer or the team responsible for developing this FX robot. From the insufficient info, we suspect that this is not a reliable company.

Prop Firm EA

| Type | Fully-automated EA |

| Price | $588 |

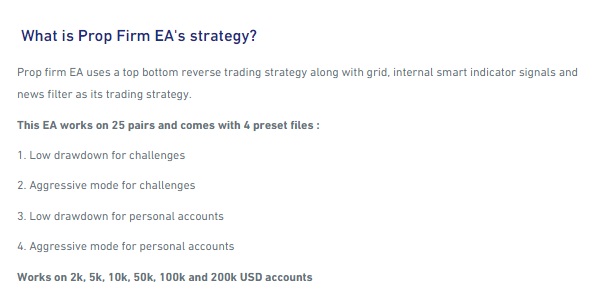

| Strategy | Top-bottom reverse trading with grid and smart indicators |

| Compatible Platforms | MT4, MT5 |

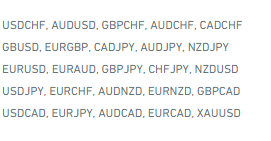

| Currency Pairs | 25 currency pairs |

| Timeframe | Any |

| Recommended Min. Deposit | $2000 |

| Recommended Deposit | $10000 |

| Leverage | N/A |

This FX EA costs $588, which is inclusive of a one-year license key. A 6-months license package is also available at the cost of $388. The package includes a full setup guide and a refund policy of 14 days. However, the vendor mentions that failure in funding firm challenges because of the firm’s privacy will not come under the refund offer. There is not much info available on the features present in the pricing packages. Furthermore, compared to other competitor EAs in the market, this product is overpriced.

Trading strategy

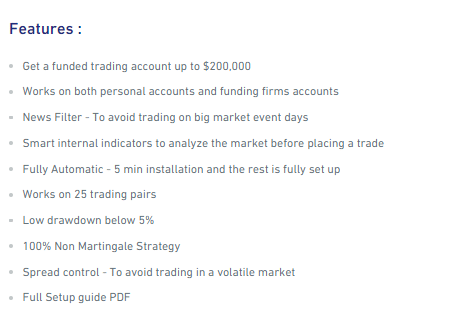

A top-bottom reverse trading approach is used by this FX EA. The grid method and internal indicator signals, as well as news filters, are employed for the trading. As per the vendor the ATS works on 25 pairs and includes 4 preset files namely low drawdown and aggressive mode for personal accounts and low drawdown and aggressive mode for the challenges. The currency pairs this EA works on are shown in the screenshot below:

Other than mentioning that this system works on accounts with funds starting from 2k up to 200k, the vendor does not provide info on the timeframe, recommended deposit, and other related info. The MT4 tool focused on the funding firm account will close its trades on Friday to avoid weekend trades. No stop loss is present as the limit set for the drawdown is less than 5%.

Trading results

No backtesting results are present for this FX EA. However, we found a live real account verified by the myfxbook site for this ATS.

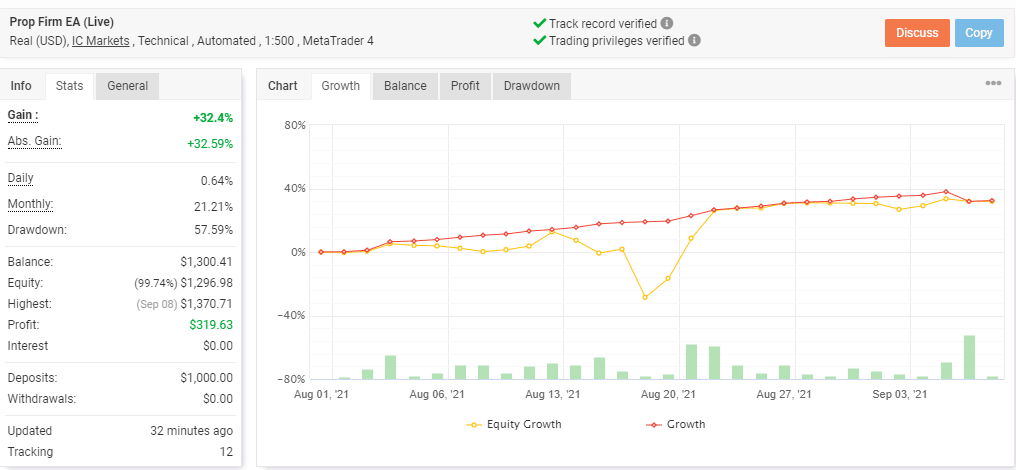

From the above screenshots, we can see that the real USD account using IC Markets broker and the leverage of 1:500 on the MT4 platform reveals a total profit of 32.4% and an absolute profit of 32.59%. The daily and monthly profits for this account are 0.64% and 21.21%.

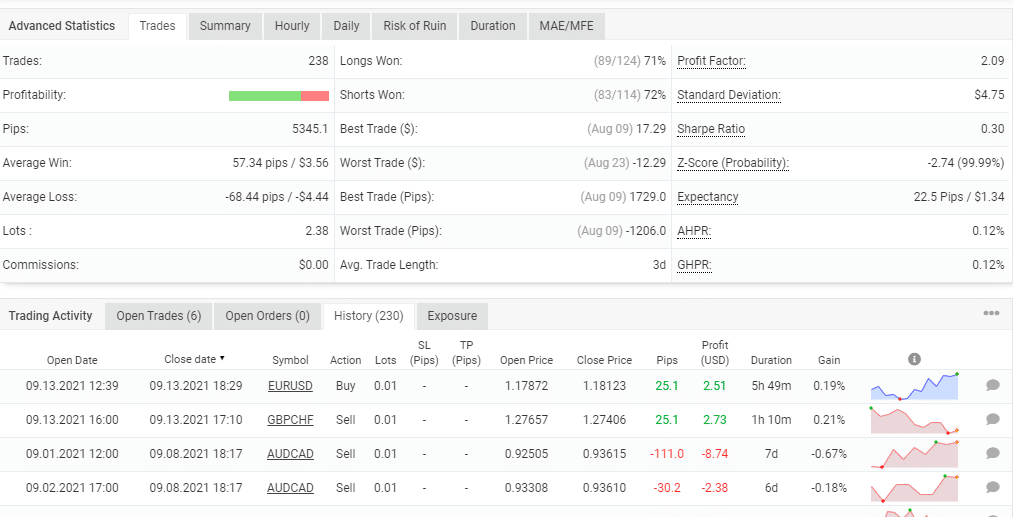

A drawdown of 57.59% is present for the account which started with a deposit of $1000 in August 2021. The total number of trades executed is 238 and the profitability is 72% and the profit factor value is 2.09. From the trading history, we can see a lot size of 0.01 is used for the trades. The high drawdown indicates a risky approach and poor performance.

Customer reviews

We found many reviews for the My EA Academy company on the Trustpilot site. Here are a few of the feedback:

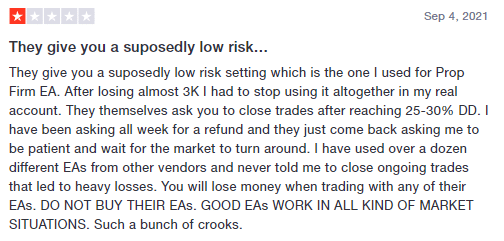

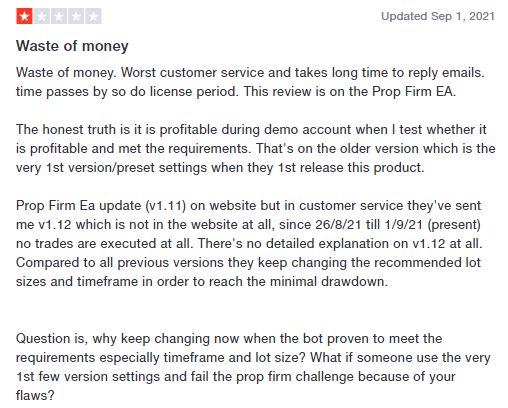

As per the reviews, we can see that the drawdown is not low as the vendor claims and has resulted in a big loss for the user. Another user complains of the bad customer services and losses sustained on using the system on a real account.