Shell Forex EA claims to be a comprehensive system that can streamline your Forex trading. It is a fully automated robot with features that ensure successful results, as per the vendor info. The vendor claims that it does not use dangerous methods like Martingale, grid, and arbitrage. Live results verified by the myfxbook site are present for the FX EA. According to the vendor, the system adapts automatically to the changes in the market ensuring better results in any type of market situation.

Product offering

After reviewing the official site, we find the info present is very minimal. Besides listing the main features of the system and a link to the live results, there are no details present on the functionality and other aspects of the FX robot. The company details is another aspect that the vendor falls short of. We could not find vendor details like the year of establishment, developer or team member info, location details, phone number, etc. The lack of info makes us suspect the reliability of the company.

Shell Forex EA

| Type | Fully-automated EA |

| Price | €49 |

| Strategy | N/A |

| Compatible Platforms | MT4 |

| Currency Pairs | N/A |

| Timeframe | N/A |

| Recommended Min. Deposit | N/A |

| Recommended Deposit | N/A |

| Leverage | N/A |

As per the info on the official site, this ATS is available for €49. The payment methods allowed include PayPal, BTC, Visa, Mastercard, and American Express cards. After you make the payment, you have to send your MT4 account number to get the EA license. Unconditional refunds and free updates are offered for the product. The vendor does not provide further info related to the features you get with the package.

Trading strategy

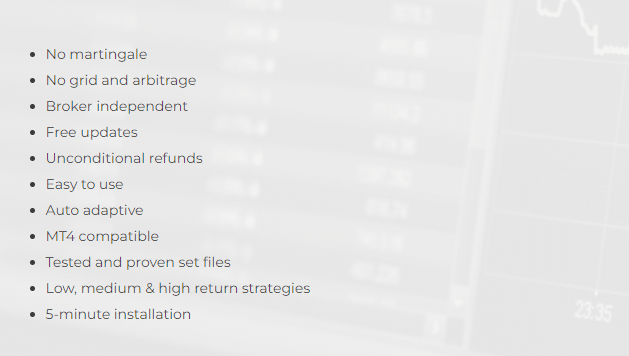

As we mentioned earlier, there is not much info revealed about the ATS. The vendor mentions that strategies that give high, medium, and low returns are part of the software. But there is no explanation of what methods they are and how the methods provide the returns claimed by the vendor. As per the vendor, the FX EA does not use the grid, arbitrage, and Martingale methods.

Some of the key features that make the MT4 tool gain an edge over its competitors, as per the vendor are:

- It is broker independent and the software is auto-adaptive.

- It has proven and tested set files that provide high returns.

- It is easy to use and the installation takes about 5 minutes to complete.

- Free updates and unconditional refunds are assured by the vendor.

We could not find details related to the recommended deposit, leverage, timeframe, brokers, etc.

Trading results

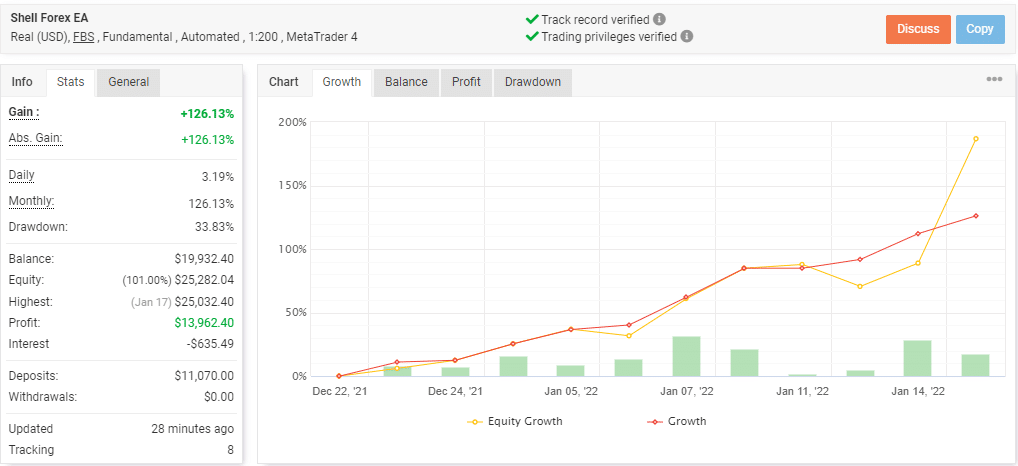

No backtesting results are present for this FX EA. A real USD account using the FBS broker and the leverage of 1:200 on the MT4 terminal is provided on the official site. Here are a couple of screenshots of the trading stats.

From the above stats, we find the EA has generated 126.13% and an absolute return of the same value. A daily and monthly profit of 3.19% and 126.13% are present. While the growth curve shows a decent increase in the profits, we find the monthly profit is very high indicating a high-risk approach. The risky strategy is further confirmed by the high drawdown of 33.83%.

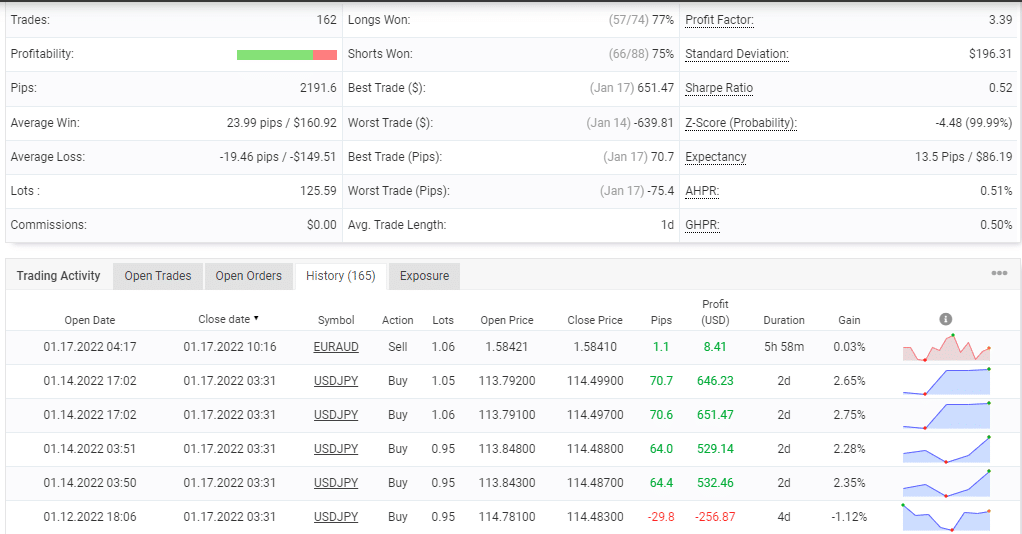

Furthermore, the account has completed only three weeks. The sample provided is very short for assessing the performance. For a total of 162 trades, 76% profitability is present with a profit factor of 3.39. From the trading history, we find the lot size ranges from 0.94 to 1.06. The big lot size also indicates the risk level is high.

Customer reviews

Unfortunately, there are no user reviews for this FX EA on trusted review sites like FPA, Trustpilot, etc. User feedback provides a better insight into the functionality, performance, support, and other crucial aspects of an FX robot. The absence of reviews prevents us from making an evaluation based on the feedback of real users.