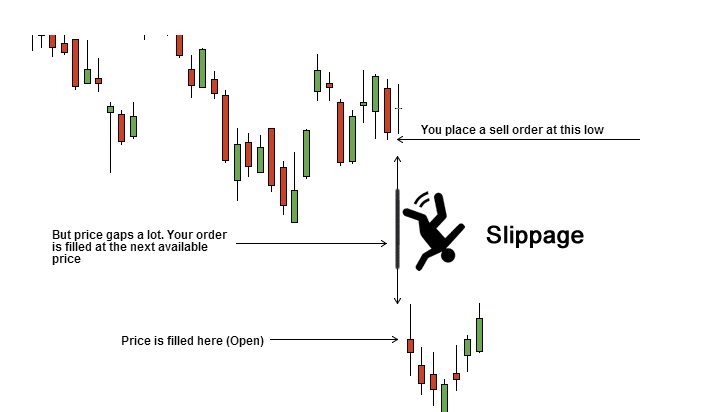

Slippage has always been a big problem for anyone looking to profit from price fluctuations in the capital markets. Whether trading manually or using automated trading systems, executing orders at the preferred price point has always been a challenge. The disparity between the expected and executed price is usually big during periods of heightened market volatilities.

Therefore, any trading strategy ought to account for slippage, given that it can have a positive or negative impact. Changes in the spread are one of the biggest causes of the difference between expected and executed prices while trading.

Periods of high trading volume can result in market orders slipping. Additionally, periods of low trading volume can result in a widespread increase because buy and sell orders are executed at completely different prices as the one envisioned in the first place.

Algorithmic trading strategies are designed to execute orders whenever desired market conditions are met. When these conditions are met, orders execute automatically, allowing traders to lock in optimum profits. However, that is not always the case, as such systems are also prone to slippage.

Whenever algorithmic systems try to execute during periods of heightened volatility, the difference in time between when the order is triggered and when a broker executed can result in losses or profits due to slippage.

Any deviation that comes about when leveraging such automated systems can significantly lower the confidence in the strategy’s intended outcomes. When slippage is not properly considered, large drawdowns or negative returns could be the probable outcome.

Whenever a winning strategy encounters slippage, significant losses could come into play, especially in the case of a big difference between the expected and the execution price. Consequently, proactive management of slippage is essential even when engaging in algorithmic trading for optimum results.

When slippage occurs

The biggest slippage or difference between expected and executed prices occurs during major news events. During these periods, retail traders and algorithmic systems jostle for positions in either direction resulting in wild swings.

Without a clear direction of the trade, price tends to move widely and could result in wide slippages. FOMC announcements, as well as Non-Farm payroll data, are some of the reports that are known to trigger wild swings in the market, making it extremely difficult to have orders filled at desired levels.

If already in a position, when such big announcements come into play, the prospects of a substantial slippage on stop loss is usually high, all but increasing the prospect of accruing significant losses. In contrast, one can end up accruing significant profit on price jumping and failing to fill profit orders.

How to limit slippage

The best strategies for countering slippage are ones that can limit the risk as it is impossible to eradicate it completely. Additionally, it is important to pay close watch to liquidity level as it also tends to influence spreads which could result in significant slippage.

Any algorithmic strategy should be tailored to account for wild swings in the form of spikes of troughs when dealing with highly liquid markets. One of the strategies could involve limiting the market orders during periods of high volume in the market. In addition, it would be wise to reduce order sizes when liquidity is low as negative slippage can have a significant impact.

While algorithmic trading is more of a quantitative and procedural option, modeling for slippage can significantly limit its pitfalls. Modeling will essentially entail backtesting a given strategy to improve on the cost model.

While backtesting a given strategy and it emerges that slippage is another cost of trading, then coming up with strategies aimed at keeping it low would be the way to go. Accounting for slippage costs as commissions or other fees would go a long way in averting surprises in the future.

Employing guaranteed stops and limit orders

Using guaranteed stops and limit orders is a sure way of ensuring orders are executed at desired price points, thus averting slippage risks. In this case, a stop-loss order will be filled even on price gapping and failing to hit the order.

A limit order also gets filled at a specified price point that is favorable for the trader regardless of price gapping higher or lower. In most cases, a sell order would be executed at the desired price point or at a much higher price. Similarly, a buy order would be filled at the desired price point or a much lower price.

However, it is important to note that such orders come attached with a premium incurred as cost once the order is triggered.

Bottom line

It is impossible to avoid slippage in high-speed trading. However, if it has a significant impact on a trading strategy performance, it is easy to limit it using well-proven strategies such as avoiding trading during periods of high volatility and using small order sizes during low volume periods.

Additionally, accounting for slippage as trading costs in trading strategy can also help in mitigating its impact on returns. In return, a firm or a trader would have confidence in a strategy while leveraging algorithmic trading.

Chances of encountering slippage can also be reduced by trading during periods of increased market activity that result in high liquidity. Increased market participants at this period make it easy for orders to be executed.