Exchange rates in the forex market fluctuate rapidly whenever the markets are opened. Amid the fluctuations, traders set prices at which they would like their orders to be filled. In a balanced market setting, a position should be filled at the defined levels by the trader. However, that is not always the case.

What is Slippage?

Slippage occurs whenever buy or sell positions get filled at a value different from what a trader requested. It occurs during periods of heightened volatility whereby trades fail to be marched with the set price target.

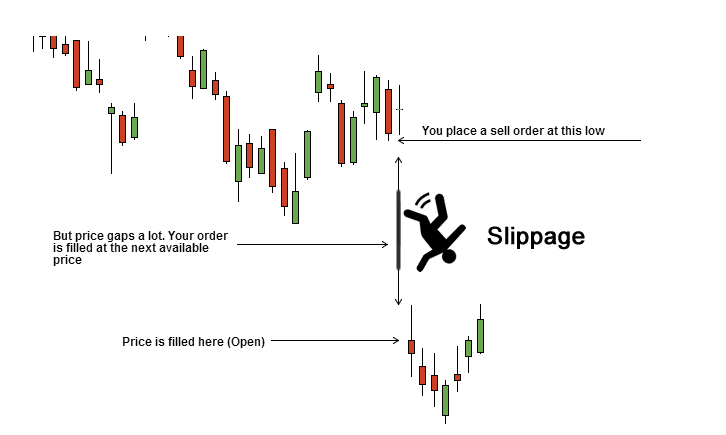

During periods of breaking news, wild swings come into play resulting in currency pairs fluctuating widely. Gaps tend to come into play, making it impossible for trades to be filled. In contrast, under normal market conditions, positions get filled without any slippage as rates oscillate smoothly up and down without any gaps.

The difference between the final and the quoted value is the slippage. It can be a bad or a good thing, depending on when it occurs. Consequently, it can produce more favorable results if positions get filled at a much better value or trigger a less favorable outcome if it gets filled at the worst rate.

How it occurs

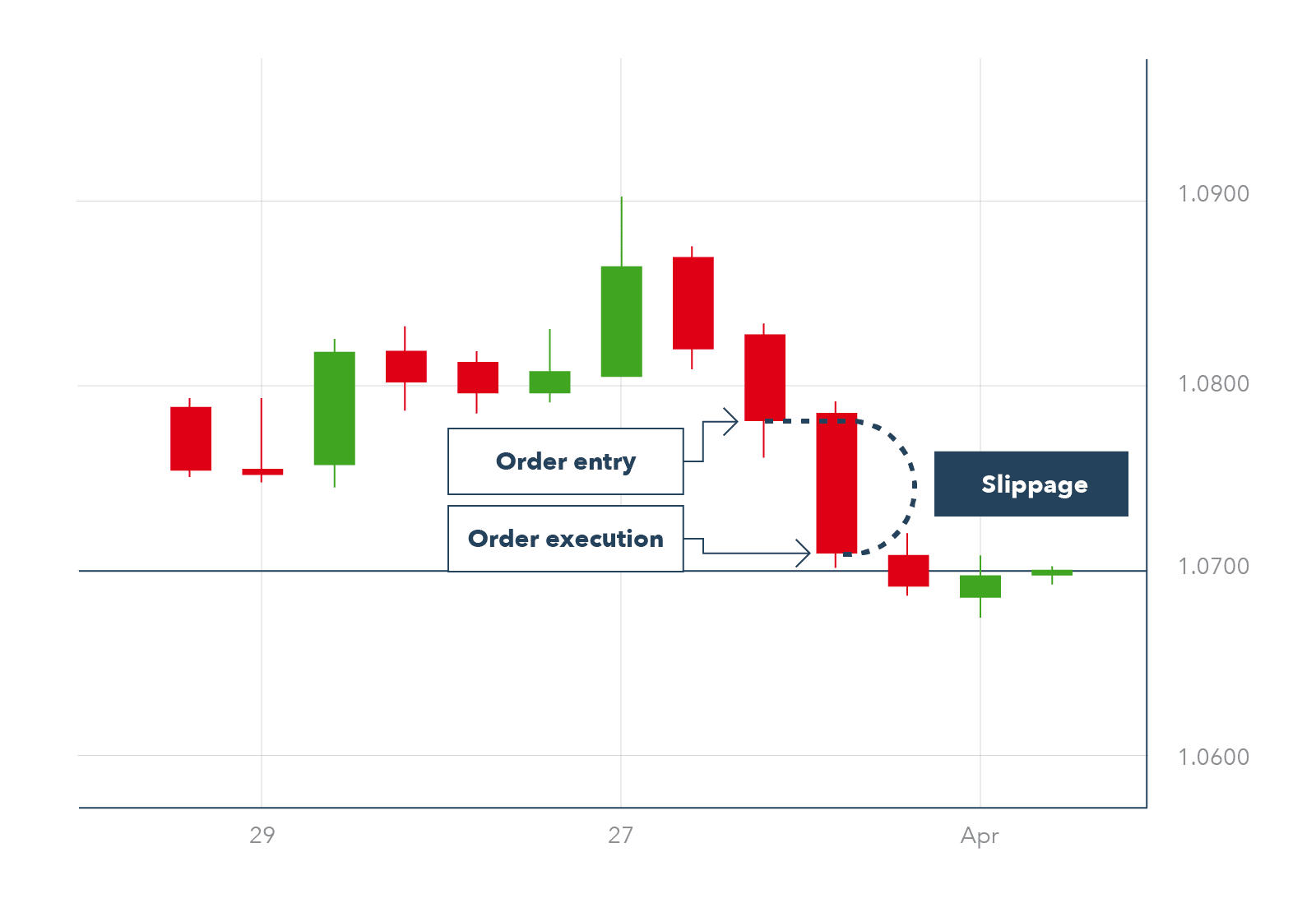

Consider a person trying to trade EURUSD on the Nonfarm payroll report. Immediately after the report is out, the person decides to place a long position expecting the rate to jump significantly. If on the trading platform, the exchange rate is 1.1256, the trader will expect the position to be filled at this price point on triggering buy trades.

Upon clicking the buy button, the order is sent to the broker for verification over the Internet. The broker will receive it in a few seconds, counter check if there is sufficient capital in the account to fund the trade.

Upon verification, the broker will execute the order if everything checks out. However, given a lapse between when the trader placed the trade and when the broker carried out the verification, the price would have changed.

A price change from 1.1256 would be even greater at this time, given the heightened volatility due to the NFP report’s impact. Therefore, instead of the position being filled at 1.1256, it might get filled at, say, 1.1266. The slippage is the difference between the quoted value and the final price, which translates to 10 pips.

Negative vs. positive slippage

Slippage can be positive if it results in a position being executed at the best available price instead of the quoted. For instance, if one was to enter a long position on EURUSD at 1.1256 only for the broker to fill the order at 1.1246, it means one ended up buying at a much lower rate gaining ten pips in the process.

In contrast, if a long position is filled at a much higher value than the quoted, it amounts to negative slippage. In the case of the example above, if the buy at 1.1256 got filled at 1.1266, one would have lost ten pips on the buy price.

What causes slippage

In any balanced market setting, there must be an equal number of buyers and sellers so that similar sell trade counters any buy order triggered at a given price point and size with the same size. The imbalance between the buyers and sellers causes the rate to move up or down.

For instance, if one wishes to buy 100K of EURUSD at 1.1780, enough people must be willing to sell 100K worth of the pair at the price point. If there aren’t sufficient people, the order will have to look at the next best available rate.

If there are sufficient or even more sellers willing to sell euros at the price point, the trader could end up getting an even better rate for the buy trade.

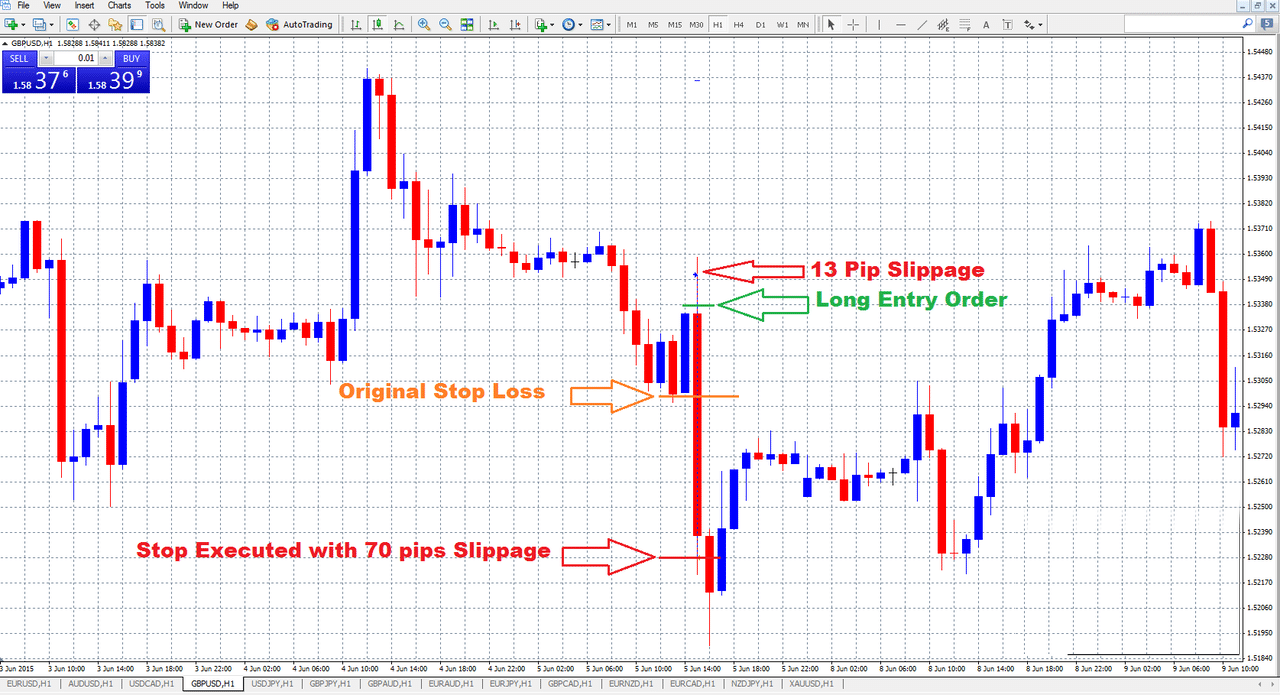

Slippage on stop loss and spreads

Slippage is not just unique to buy and sell directives. It is also a common occurrence on stop-loss orders. In some instances, stop losses cannot be honored, especially on the market gapping higher. If this were to happen, then one might end up with a much bigger loss than initially anticipated.

However, there are guaranteed stop losses that cannot be bypassed even with the market gapping higher. Such orders will be honored with the broker no matter the underlying conditions on the market.

Slippage can also occur if there is a surprise change in the bid/ask spread from when it gets triggered and when it gets filled. For instance, if the spread was to increase while placing a buy or long position, one could end up paying a much higher price than intended. Similarly, if the spread were to decline, one would end up paying a much lower charge.

Consider EURUSD is trading with spreads of 1.1230/1.1240 on the broker interface. If a person decides to enter a long position, they expect it to get filled at 1.1240. However, the time difference between when the order is placed and when it gets executed could see a lift in spread to 1.1240/1.1250, which could see it get filled at 1.1250, meaning ten pips above the intended price.

Where does slippage mostly occur?

Slippage tends to occur in low liquid currency pairs in the forex market. The exotic and minor currency pairs are prone to slippage, given the imbalance between buyers and sellers. The lack of people willing to buy or sell makes it extremely difficult for orders to fill at the preferred price points.

On the other hand, major currency pairs experience slippage the least amount of time, mostly when the markets are volatile. This is partly because such pairs attract many buyers and sellers at any given time, thus high liquidity. The fact that there are a significant amount of buyers and sellers willing to sell or buy at any given price point minimizes the prospect of slippage coming into play.

How to avoid slippage

One of the best ways to avoid the pitfalls of slippage is to trade non-volatile and liquid markets. Low volatility comes with smooth price action, while liquidity ensures an order gets filled. In this case, exchange rate changes are not erratic; thus, the trade gets filled easily.

The use of virtual private servers is also gaining momentum as a way of avoiding slippage. VPS ensures the best execution at all times regardless of technical mishaps such as internet connectivity downturns