NinjaTrader 8 is a trading software that enables people to conduct analysis on thousands of assets, develop strategies, and execute trades. Many traders use it as an alternative to MetaTrader 4 and MetaTrader 5. In this article, we will look at the concept of the strategy development process with NinjaTrader 8.

What is a trading robot?

A trading robot herein referred to as a strategy or expert advisor is a piece of software that traders use to automate their trades. The bot can conduct an analysis of a currency pair or another asset and then execute trades. In most cases, trading robots are used by advanced traders.

There are several benefits of using a trading robot. First, the robot can do multiple analyses at once and execute trades even when you are not around. As a result, this will save you time and help you execute trades that you could have found manually.

Second, robots can work for longer hours than an individual. For example, you can set the robot to conduct analysis and open trades even when you are at work or asleep. As such, if it is a good strategy, you can increase your profitability.

Third, well-developed strategies can open trades and set the take-profit and stop-loss levels according to your risk and reward ratio. As such, you can be sure that you will not lose more money than you are prepared to.

Two methods of strategy development

An automated trading strategy in NinjaTrader is simply a piece of software that will analyze assets for you and then execute the trade.

Therefore, the first method of building these strategies is the manual process. This is where you sit down and build the software code using a programing language. As you already know, there are many programming languages that are available in the market today such as PHP, Python, and HTML. in NinjaTrader, the native language is known as C#, which is a popular language among developers.

The manual building process is relatively complicated and is not ideal for people without coding experience. It is also highly time-consuming.

The second approach is to use the automated process that uses a number of presets in the system to build the software. In this article, we will focus on this approach.

Idea generation

The first step you need to follow when building your strategy is known as idea generation. This is the simple process in which you consider everything that you want in your automated strategy. It is one of the first things that you need to do.

We recommend that you use a piece of paper to envision what you want to achieve in your building process. Taking time to do this will help you in two ways. First, it will help you to think critically about your idea. Second, it will help you try to find out whether a similar idea exists in the NinjaTrader ecosystem. If it does, all you need to do is to change the variables, which will save you time.

Open the strategy builder

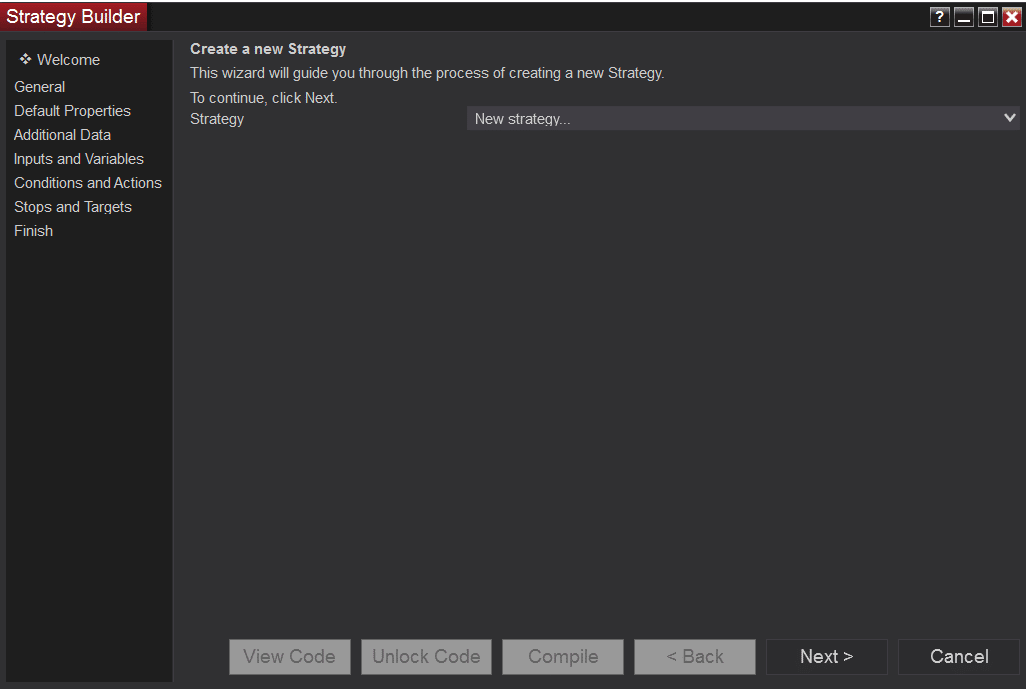

The next step is to open the strategy builder. You do this by going to the dashboard and selecting new. At the lowest side of the options, you will find the option known as strategy builder. Opening this option will open the option shown below.

On this page, you should select the new strategy option and then click next. On the next page, enter the name of the automated strategy that you are building and a brief description of it. Just make it a memorable name.

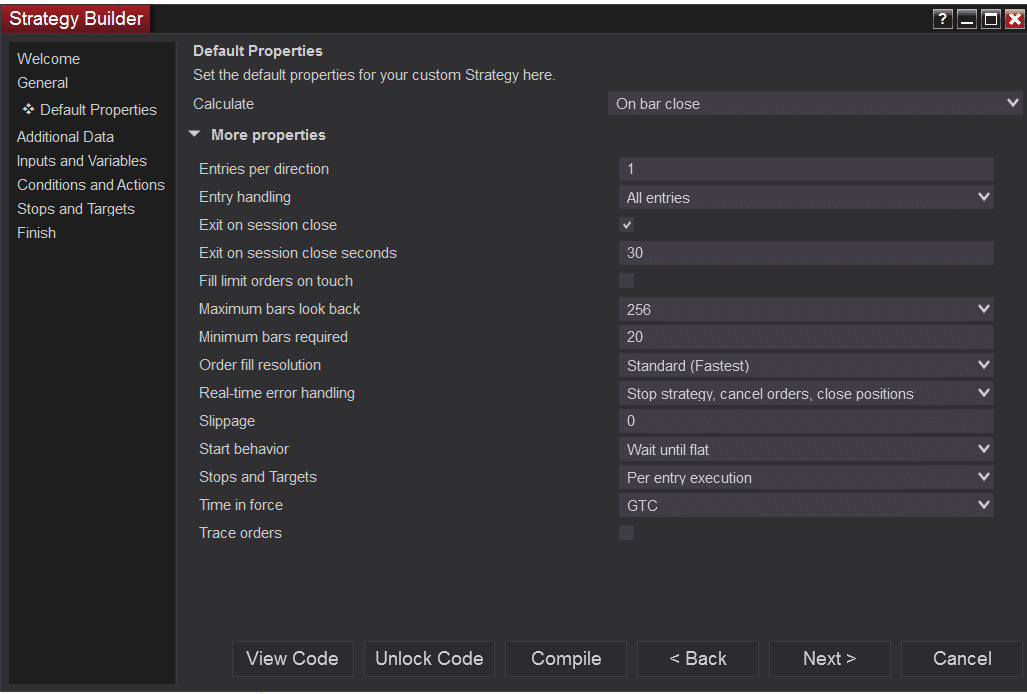

On the next page, you should select the default properties of the strategy that you want to build. Some of the options you need are entries per direction, entry handling, and exit on session close. Most people find the default selections to be good.

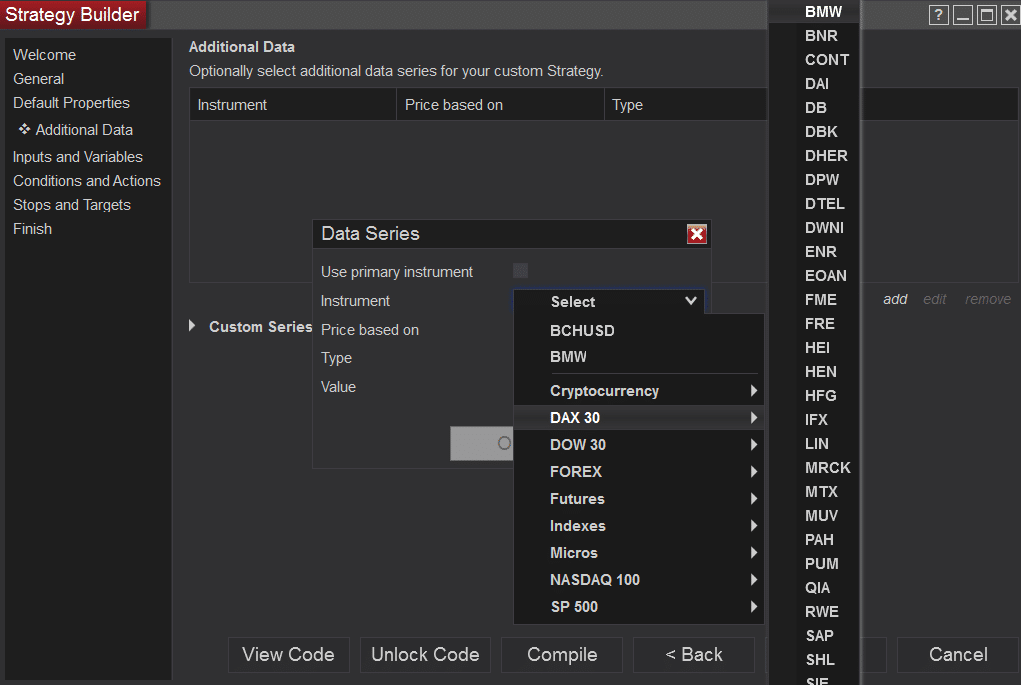

On the next page, you should enter any additional data that you need in your robot. On this page, you can enter the asset that you want the robot to track like futures, forex, indexes, and the S&P 500 among others. When you select the S&P 500, you can select the specific companies that you want the robot to track. In the chart below, we selected the DAX index and then selected BMW.

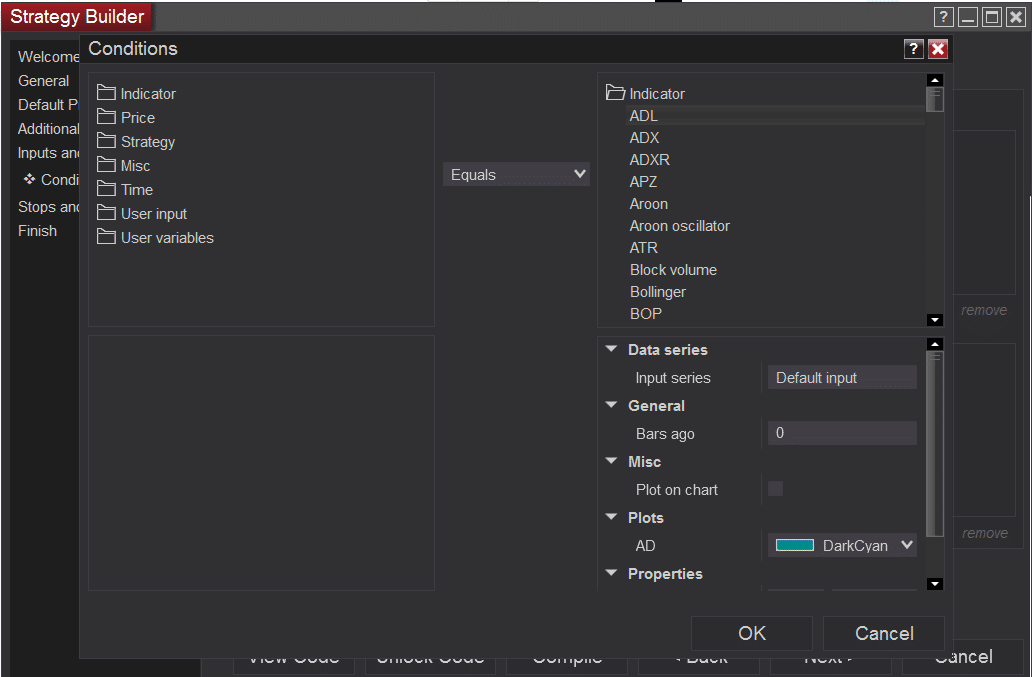

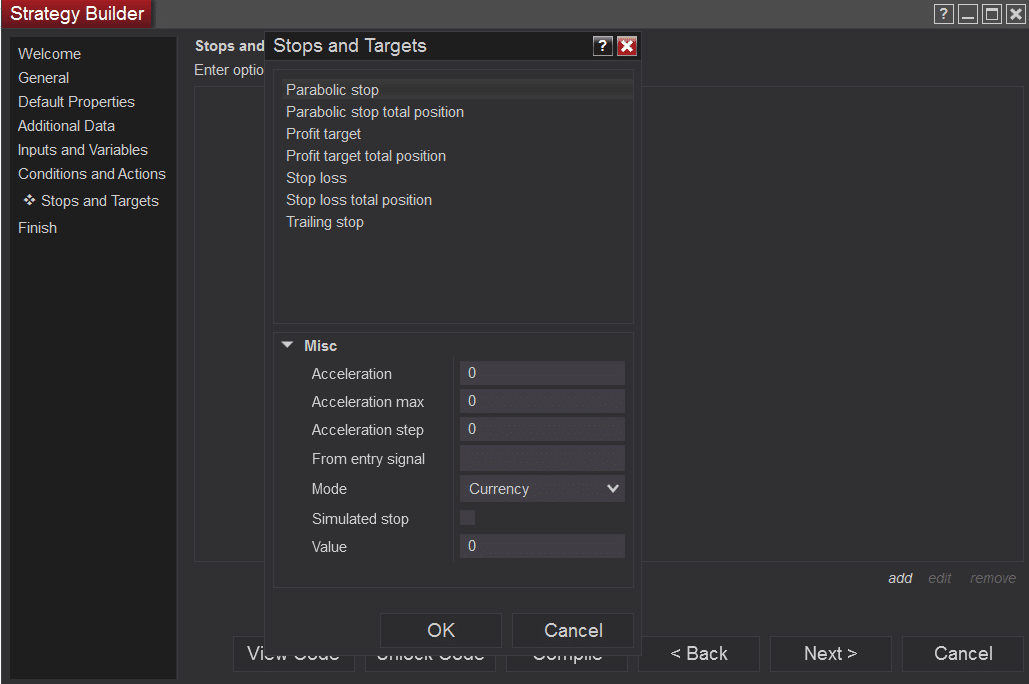

In the next few dialogue boxes, you will enter conditions that need to happen in the strategy, input and variables, and stops and targets. After you enter all these details, you will have your strategy ready. The chart below shows how to select technical indicators that you will use to analyze the asset.

For example, in the conditions, you can add something like: open a buy trade when the BMW stock moves above the 25-day MA on the hourly chart.

The final chart above shows how to enter the stop-loss and take-profit conditions in the chart.

Strategy tester

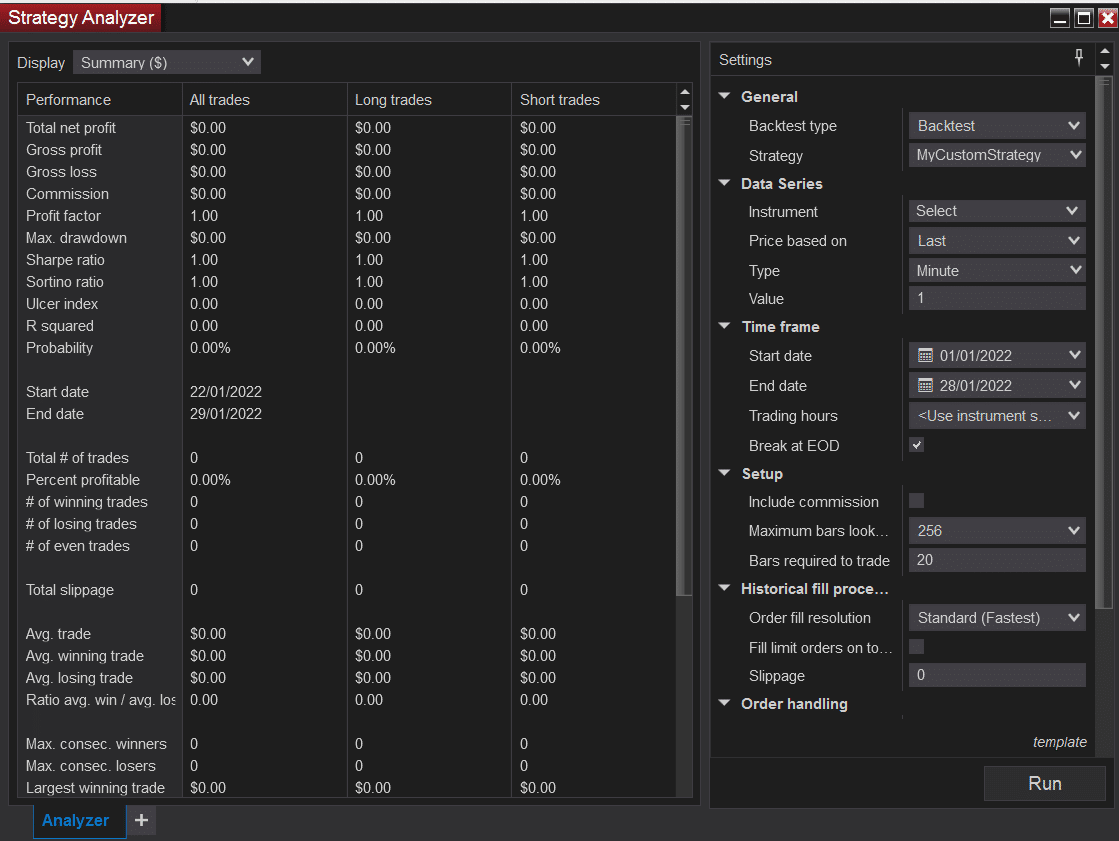

The final process when building an automated strategy is where you test the strategy. NinjaTrader has a strategy tester, which you can access by going to new and the strategy analyzer. The chart below shows what the strategy tester looks like.

In this tool, you should go to the settings tab and then select the type of backtesting. As you will find out, there are several options like backtesting, optimization, walk-forward optimization, and multi-objective optimization.

Next, select the strategy you want to test and the asset or instrument. Most importantly, select the dates that you want to test. After this, you should work to fix the strategy based on its performance.

Summary

The NinjaTrader is a great trading platform that is offered by a number of companies. It is provided by a smaller slate of companies than those which offer MT4 and MT5. In this article, we have looked at how you can build and test a strategy using NinjaTrader 8.