Whether you’ve been trading forex for a few days or a few years, you will undoubtedly have heard of the terms ‘liquidity,’ ‘volume,’ and ‘volatility’ interchangeably used.

At any given moment, the markets are moving through many different phases of liquidity, volume, and volatility to tell us a story.

This means you can always derive a relationship when you grasp each of these concepts individually and interpret them to understand price movements better.

What is liquidity?

Everyone the world over is exchanging value frequently using a myriad of different currencies. Hence, the demand for foreign exchange will always be very high, making this instrument impressively liquid.

Liquidity in forex simply refers to the ease of buying and selling pairs without tremendously affecting their price. The ability to open and close a position within a second is due to the substantially massive liquidity, thanks to the millions of people and institutions exchanging currencies.

By being liquid, it becomes incredibly cheap to trade as having more people trading lowers the cost of providing a brokerage service.

Secondly, this element fosters relatively stable price movements because you can close a large position on a pair without dramatically altering its value. This means you will rarely find erratic ‘jumps’ in price, making it hard for analysts to predict where the market is likely to go next.

So, what affects liquidity? Although demand for forex is massive, not all pairs share the same liquidity levels, meaning some are less attractive to speculate in than others.

One of the primary methods for measuring this is volume, which we’ll cover next.

What is volume?

Volume in forex merely denotes the quantity or how much of a market or pair is traded in lots or contracts. However, it’s often a misunderstood topic because forex is an entirely decentralized market.

No one can see how much volume every trader in the world has for a particular pair. This contrasts with securities like futures traded through centralized exchanges where this information is readily available.

The least effective method of measuring volume in forex is using technical indicators because these tools are lagging. Another approach, although more general, is just understanding the impact of certain market periods.

For instance, during the start of specific sessions (e.g., the New York or Asian session), we naturally expect a higher influx of traders from particular regions.

With an increase of speculators, people are encouraged to trade more, resulting in higher volume. Since more money is exchanging hands, liquidity increases as we can get in and out of the markets much more quickly.

In other quieter periods, people are less incentivized to be in the markets, meaning lower volume and liquidity. We might find that it takes a little longer to open and close positions.

Another way traders predict volume shifts is by observing key technical levels in the form of support and resistance. There is a perception that everyone is watching these areas expecting that a big move may be on the cards.

While we understand that volume equals size, this tells us little about how far that size can take us; this is where volatility comes in.

What is volatility?

The third element tying it all together is volatility, which refers to the extent or degree prices change over a defined period. In other words, traders are interested in knowing how much ground a pair can move from point A to B and roughly how fast.

Volatility is affected by a number of things, but one of the key ones ties back to volume. Markets like EURUSD are characterized by being immensely liquid, meaning there are always many traders (higher volume).

This results in lower volatility or smaller price increments because it would take a massively-sized order to enforce a noticeable price change.

Conversely, illiquid pairs (most notably exotic pairs) are much more volatile, meaning the price can move in a more pronounced manner.

As fewer people are trading these markets (lower volume), a large order can easily ‘manipulate’ the price to go in one direction or the other, which would be harder on a more liquid pair.

Putting it all together

We want to trade in highly liquid markets with enough volume and not too much volatility.

This is affected by several factors, the first of which are the markets you analyze. Although the volume is usually at a peak, if you trade the major pairs, the price doesn’t move that much in the distance.

With minor pairs such as JPY or GBP-based instruments, these markets are inherently more volatile with relatively high volume. This means you can bag more pips in less time than you would by trading the major pairs.

Exotic markets are characterized by fairly low volume (as fewer people are interested in these instruments for numerous reasons), the volatility is even higher. Understanding these concepts also affects the times you trade.

For instance, it’s a well-known premise that high-impact news periods can sometimes result in erratic or pronounced movements because of the amount of volume or people trading at those times.

Let’s now explore an example of how one could have interpreted these concepts in a real market.

Example

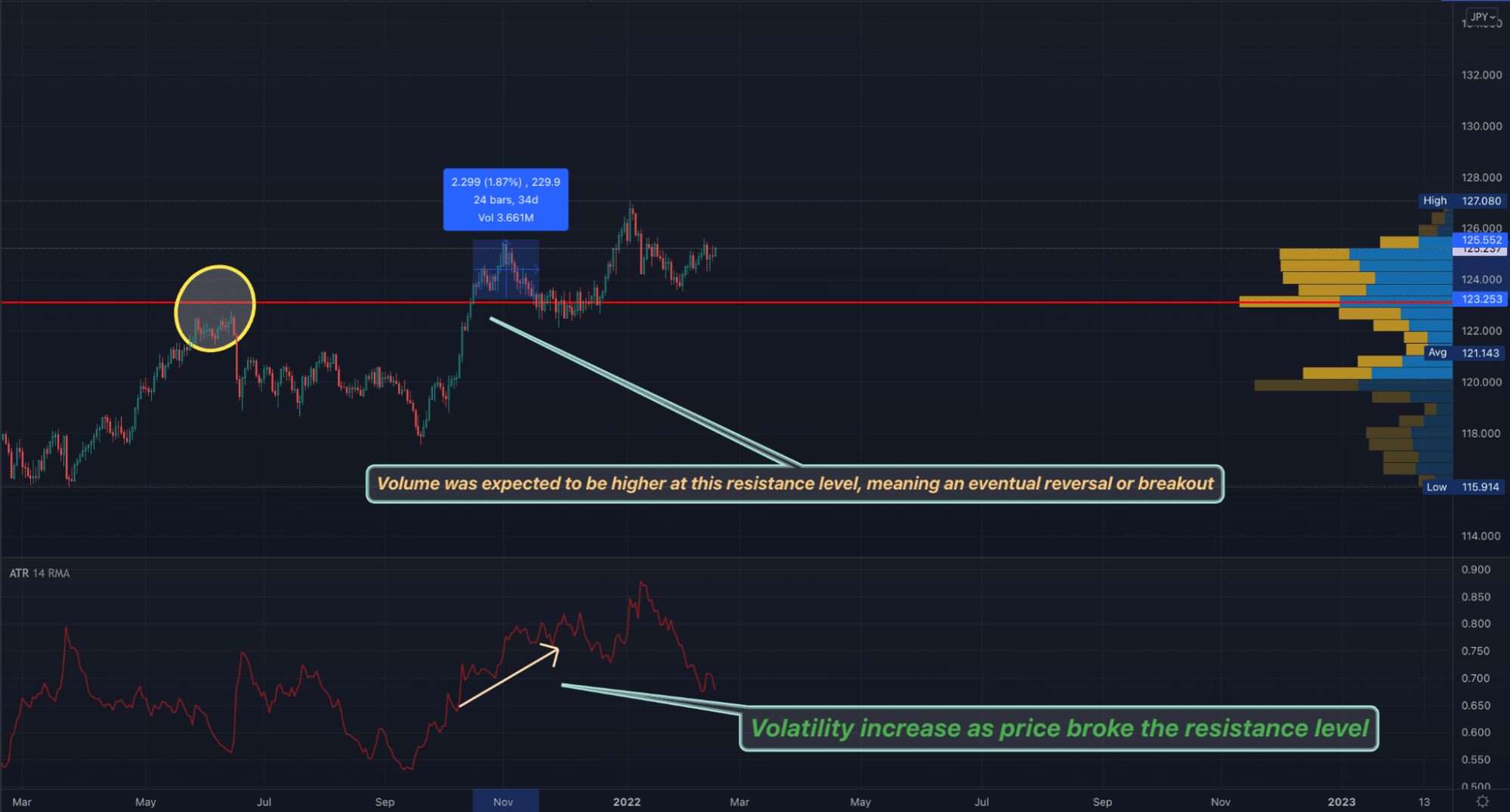

The chart below shows CHFJPY in the daily time frame. We have applied the volume profile (on the chart’s right side) and Average True Range (for volatility; at the bottom).

The red line automatically plotted by the volume profile tool identifies an overwhelming amount of volume at a prior point. The area marked with a yellow ellipse shows a resistance level.

When price revisits such an area, there’s an expectation that it will either ‘bounce off’ and reverse or cause a breakout. We had previously mentioned that you could expect higher volume at certain key technical levels. As we see in the chart, the market broke out due to greater volume.

This came with the price traveling a greater distance (about 229 pips more), resulting in higher volatility (as highlighted on the ATR), typical of a minor or cross pair like CHFJPY.

Curtain thoughts

Generally, liquidity in forex is almost guaranteed to be constantly high thanks to the advancements in order routing technology and how much money continually circulates this market.

Yet, volume and volatility are the two things that are never constant. The main takeaway is how liquidity, volume, and volatility affect numerous things, such as which pairs you trade, when you trade them, and how to predict certain movements before they happen.