Trading robots are important tools that many forex traders use. The robot is used to automate and at times simplify the trading process. Bots are used by both small retail traders and large institutional investors.

When used well, trading robots can outperform manual traders. For example, the Medallion Fund, run by a hedge fund known as Renaissance Technologies, has outperformed most funds for years. The fund has achieved annualized returns of >66% in the past 30 years. In contrast, the S&P 500 and Warren Buffett’s Berkshire Hathaway have returned much lower over the years.

Therefore, in this article, we will look at how trading robots work, how they are built, and why, in most cases, they tend to do well in forex but not in stocks.

How trading robots work

Trading robots are quantitative tools built mostly by people with experience in trading and software programming. The idea behind them is simple since they codify your manual trading strategy. For example, assume that you are a trader who focuses on MACD crossovers. In this case, a buy signal emerges when the two lines of the MACD cross one another below the neutral line.

In manual trading, you need to wait for this crossover to happen, and then you can implement your trade. On the other hand, you can create an automated robot that automatically opens a trade when the same conditions happen.

Additionally, in manual trading, you can only look at one chart at a time. A well-created robot can look at multiple charts at the same time and identify these trading opportunities. The robot can also have other features like stop-loss and a take-profit.

Therefore, many people prefer using trading robots in the financial market. Implementing them in platforms like MetaTrader and Ninja Trader is an easy process also.

How trading robots are built

Trading robots are built using two main ways. The most extensive method of building trading robots is to do it manually. The process involves having a good understanding of programming languages and the financial market.

The second approach is that of using expert advisor builders. In this process, you simply use a free or paid builder like fxDreema and EA Builder Pro to build the robots. This process is simpler and can save you a substantial amount of time since all you need is to drag and drop the parameters.

The final method of using robots is to use those that have already been built. Robots can cost as little as $10 to thousands of dollars. While there are many places where you can buy a robot, we recommend that you use the official marketplace of the MetaTrader 4 and MetaTrader 5. These platforms are safe and have verified reviews and ratings that you can trust.

Why robots work well on forex than stocks

In our experience, we have realized that many forex robots usually work well when used in the forex market than in stocks.

There are three main caveats. First, it is possible to trade stocks using robots but you need to be a bit careful about the robot that you use and the settings that you chose.

Second, while robots work well on forex, there are some forex pairs that don’t work well at all. For example, it is almost impossible to trade a currency pair like USD/HKD using a robot because of the Hong Kong dollar’s peg on the US dollar. This peg means that the pair is always in a tight range.

Morning gappers

A good reason why robots work well with forex and cryptocurrencies is because of how these two markets work. The forex market is open for 24 hours every day Monday to Friday while the crypto market is open 24 hours seven days a week.

The stock market, on the other hand, has a shorter timeframe since it is open for a few hours every day. In the United States, the regular session starts at 09:30 a.m and closes at 04:30 p.m ET. In Europe, stocks in Germany, the United Kingdom, and France all open for a few hours every day.

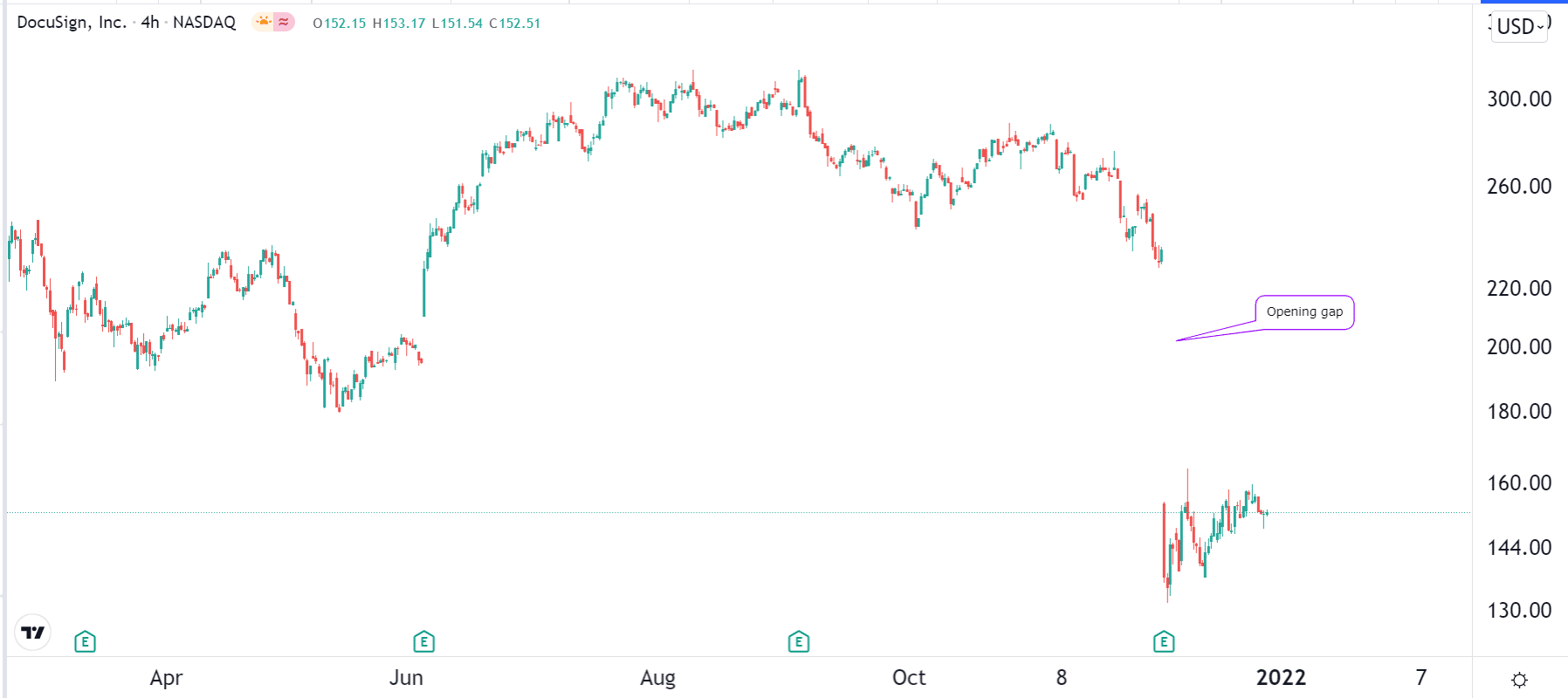

Therefore, a common reason why robots don’t work well in stocks is that of the morning gappers. A gapper is when a stock opens at a significantly higher or lower position than where it ended the day. For example, if a stock ends the day at $20 and then opens at $17, that is known as a gapper.

Gaps happen for a number of reasons. For example, a company could report weak earnings after the market closes. It could also a management change or an acquisition deal.

The challenge is that it is almost impossible for a trading robot to predict when a large gap will happen and the direction of the gap. When the gap happens, it is usually because of fundamental events and not technicals or price action. The gap can also interfere with the original technical cases.

Gaps can lead to substantial losses when they move against you. Also, the price action after a bullish or bearish gap can be hard to predict.

Still, there is a way to remedy a gapping situation. For example, as a stock trader, you can deactivate the “algo trading” when the market is nearing its closing price and then restart it in the regular session.

Summary

Trading robots are popular tools among experienced traders. They are applicable in all assets like stocks, cryptocurrencies, indices, and commodities. But in most cases, these robots mostly work well on cryptocurrencies and forex, markets that are open continuously for a long period. Still, you can create advanced stocks robots.