Using bots to purchase and sell commodities on global stock markets has been a long-standing practice for businesses. There is less pressure on corporations and traders when they use trading bots.

Trading bots are software programs that communicate with financial exchanges through the use of application programming interfaces (APIs). They watch exchanges around the clock and respond to them in accordance with the specified criteria they are configured to meet.

Building a trading bot

There are numerous approaches to developing a cryptocurrency trading bot. Finding an open-source crypto bot that you can immediately download and use is the most cost-effective and simplest method. Even if you don’t have a lot of experience with computer programming, you can still benefit from this method.

You will, however, require at least one expert software programmer to add your own features, maintain development, and repair any bugs/security issues that may arise. However, there are certain drawbacks to this strategy, such as the difficulty of adding your own features or changing the bot’s trading algorithm.

Best bot building sites

We’ve compiled a list of the top resources for constructing bots in the following section.

Bitsgap

Aiming to keep everything under one roof, Bitsgap is a comprehensive automation platform. Even when the exchange front-end freezes, the system manages to achieve a balance between cloud-based support, automation, and appropriate order executions. Using the Bitsgap trading bot, you may trade on over 25 different cryptocurrency markets.

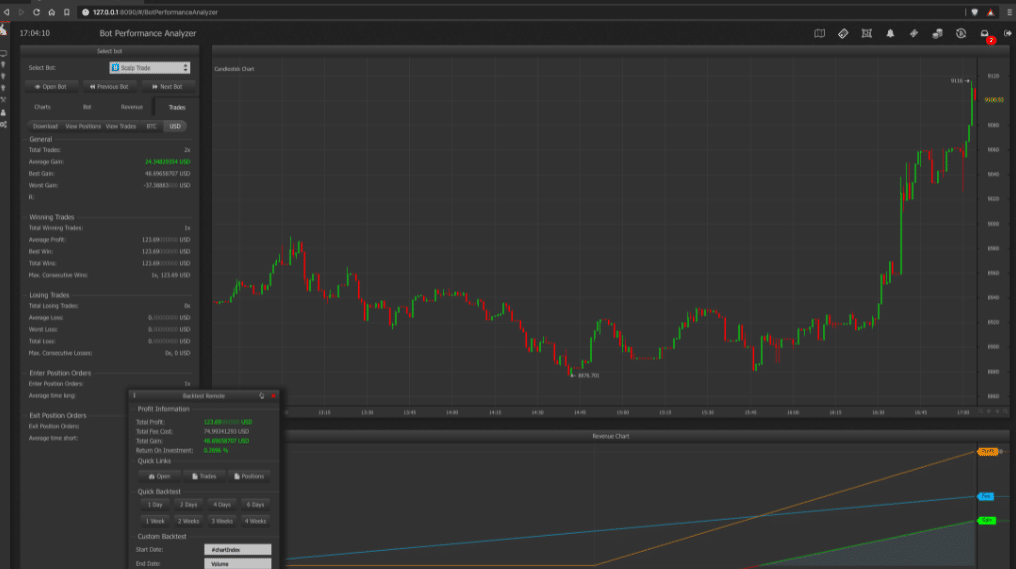

Machine learning enables the usage of pre-configured bots that don’t require any programming on your part. Using Bitsgap’s backtesting feature, traders and portfolio managers may optimize automation so they can maximize returns in an ascent and protect their investments in a downturn. Analysts and programmers use the data provided to develop the finest trading solutions based on historical data.

Trality

With Trality’s Rule Builder, you may create algorithmic trading bots by dragging and dropping technical indicators built on Boolean logic into your trading strategy. This is the equivalent of creating your own trading algorithm without writing a single line of code.

Smart autocomplete, and backtesting is two of Trality’s many in-browser coding tools. Its straightforward Python integration and specific documentation make advanced bot construction easier.

With Traliity’s browser-based Python Code Editor, you can employ your Python knowledge and create sophisticated bots. If you want to backtest and trade in real-time, you may do it with ease using the ever-expanding collection of packages, debuggers, and ML modules available.

You never miss a transaction since your algorithms are always running. The use of cloud-based trading servers eliminates the need to build up your own server. To further protect your assets, Trality exclusively makes use of official exchange APIs.

Tradesanta

TradeSanta is a cryptocurrency trading platform that automates trading on some of the largest cryptocurrency exchanges. Using user-specified algorithms, its bots regularly place fresh orders. TradeSanta requires you to create an API key for the exchange you wish to utilize in order to set up a bot.

An API is merely a few lines of code that TradeSanta can use to perform your actions on your behalf. In other words, it can access your account balances and place orders. Users can quickly and easily develop their own bots using Tradesanta’s bot templates. You may have a trading bot up and running in less than five minutes using pre-set templates, or you can develop your own strategy from the start.

Through the use of graphics, TradeSanta demonstrates the many strategies that you might use. Make use of a variety of cryptocurrency exchanges with automated trading bots. There are bots that can trade in both spot and futures markets, allowing you to take advantage of leverage. In addition, Tradesanta includes tools to enable you to build bots that can take advantage of both bull and bear market conditions. Using them, you may program a robot to make and take positions in the stock market.

Haasonline

With support for more than 20 exchanges, Haasonline is a force to reckon with when it comes to creating trading bots. The platform’s visual editor and HaasScript’s scripting language make it easy for users to build, test, and deploy scripts in minutes across several exchanges. With Haasonline’s drag-and-and-drop script designer, you can quickly design and develop HaasScripts.

If you don’t know how to write code, you can still put together a working strategy by putting together logical building blocks. It’s possible to build advanced trading strategies using the 500+ graphic blocks that include mathematical and graphing elements.

By using its many visual blocks, it’s also possible to create unique strategies and indicators without writing any code. Technical indicators are also available to users, who can utilize them to generate buy and sell signals and to control their risk further.

With historical and real-time market data, you may test your bot strategies using Haasonline’s backtest and paper trading services. By testing your strategies under a wide range of market scenarios, you can evaluate how effective they are.

Quadency

Formed in 2018, Quadency is located in the metropolitan area of the city of New York. You can write your own trading bot in Python utilizing Quadency’s programming tools. Any multi-market and multi-exchange strategy can be implemented using event-based (real-time) or candle-based algorithms. The process of setting up a trading bot is simplified by the inclusion of a short tooltip for each set. The strategy settings are different from the regular settings.

Quadency’s Smart Suggest function gives users hundreds of profitable backtested setups that they can copy and modify to their own specifications. In order to evaluate your configuration using past data, the backtesting feature is available. For each configuration, you’ll see the ROI and profit/loss on a graph in the backtest tab.

In summary

There are many advantages to using cryptocurrency trading bots to help make your life as a trader easier and more efficient. We’ve highlighted some of the most popular platforms for building your own bots. It’s great that certain platforms allow people to create bots without coding experience. The key to making money in the crypto market is to comprehend the market’s dynamics and to recognize that trading with bots is not a one-size-fits-all answer.