Typically, foreign exchange traders fall into four classes: scalpers, day traders, position traders, and swing traders. On the one hand, scalpers and position traders occupy the extreme ends of the forex trading time frames, where the former hold positions for as little as a few seconds, and the latter’s positions could go on for years.

On the other hand, day traders and swing traders fall somewhere in the middle of the continuum. In particular, day trading involves opening and closing positions within a single trading day. The approach aims to exploit the intraday volatility in the market.

For swing traders, the time frame is longer than both day trading and scalping but often shorter than position trading. Each trading strategy fits a particular class of traders, and it could be inappropriate to pronounce any as the best. Nevertheless, today we will spend time on swing trading, emphasizing the best currency pairs to apply this strategy.

Introduction to swing trading in forex

Swing trading is a forex trading style used to exploit price swings for profit. In financial markets, a swing describes the scenario where a security’s price changes in value rapidly in either direction.

The market must experience substantial pressure from external forces to produce such a sharp shift in price action. The external force could be an unexpected interest rate decision or any other event with a massive impact on the global foreign exchange market.

A swing trader, therefore, aims to exploit the sharp shifts in price action. But this means one must be able to anticipate the swings. Unfortunately, some of the sudden changes are unpredictable, but experienced traders can foresee some.

We should reiterate that swing trading is neither short-term nor long-term. The trading style falls anywhere from holding a position for a day-and-a-half and several months. Most importantly, it would be best to catch a swing when it happens, and the earlier you do it, the better.

Swing high vs. swing low

The most exciting part of forex is that you can trade both sides of the market. In the same breadth, price action swings can happen when the market is trending upwards or in a downward descent.

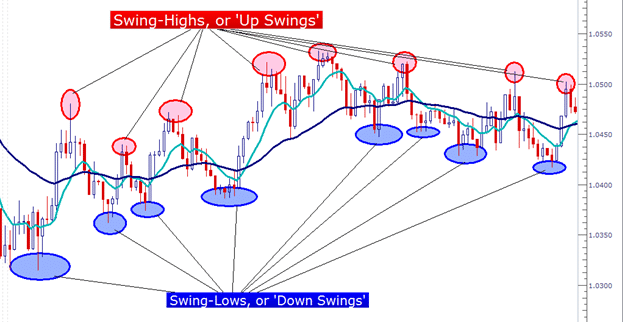

Swing high and swing low are critical concepts for successful swing trading. Although different traders have different definitions, below is the market consensus on the definition of swing.

A swing high refers to the peak that price action reaches before commencing a decline. This phenomenon forms when the market is trending up. To spot a swing high on a candlestick price chart, look for the highest candle just before a correction.

On the other hand, swing lows form in a down-trending market. Usually, it is the lowest price point on a chart immediately before an upward correction.

Swing highs and lows are critical concepts when identifying the right swing trading strategy. They indicate when to enter or exit the market and when to execute. Typically, swing highs and lows form in a ranging market.

Best currency pairs for swing trading

So far, it is apparent that swing traders thrive in a market with sufficient volatility to generate sharp shifts in price action. By extension, the best currency pairs for this trading style must fulfill the two necessary conditions below.

1. The currency pair should exhibit substantial volatility.

Volatility in forex refers to the price gyrations of currency pairs. Typically, a volatile pair records a substantial difference between the opening and closing prices, often more than 50 pips.

Usually, pairs involving safe-haven currencies like the US dollar exhibit more stability hence lacking requisite volatility. Contrarily, emerging market currencies tend to fluctuate a lot, meaning the associated pairs are often volatile.

2. The currency pair should have sufficient liquidity.

Liquidity is essential for two primary reasons: Traders need to lock in profits, meaning they need their sell orders fulfilled in good time. Secondly, they need to limit losses. It means being able to rely on the stop-loss order to execute at the required price point.

From the preceding, the following below are the best forex pairs for swing trading.

AUDJPY

The Australian dollar (AUD) has an exciting relationship with the Japanese yen (JPY). For starters, the AUD is popular in risk-on markets – when risk appetite is high. Traders love the currency in such conditions because it tends to generate returns.

More importantly, the AUD is backed by an economy that trades mainly with emerging markets in Asia, whereby Australia exports commodities like coal to China and other Asia Pacific countries. The problem is this relationship only pays off when the global economy is stable. As such, the AUD often exhibits high volatility.

The JPY is a diametric opposite of the AUD, primarily because it becomes attractive in risk-off market conditions. Traders view the currency as a safe haven, one that safeguards value in a downturn.

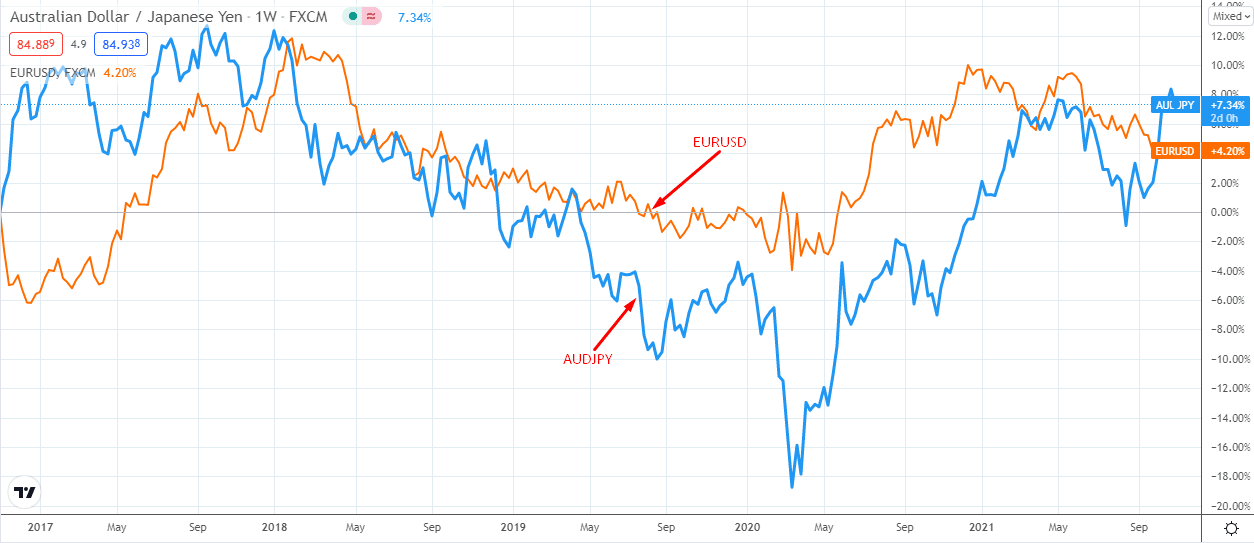

Thus, the AUDJPY displays substantial volatility and is prone to sudden swings. In addition, the currency pair consists of major currencies whose global demand is sufficient to maintain an acceptable liquidity level.

For context, let’s compare the AUDJPY’s price chart to the EURUSD over the past five years. You’ll notice that the latter’s price action (orange line in the chart above) is smoother over the long term.

CADJPY

Interestingly, the CADJPY displays the same relationship as AUDJPY. In the first place, the CAD also relies heavily on commodity exports, making it prone to volatility. This also makes the currency attractive in risk-on markets.

Contrariwise, and as already discussed, the JPY only catches the attention of risk-averse traders. Because of the inverse relationship, the CADJPY’s price action is capable of sharp shifts in the medium term.

GBPAUD

Since the 2016 Brexit vote, the British pound (GBP) has been one of the most volatile currencies in the world. This worsened during the Brexit negotiations, whose highlight was elevated uncertainty.

We are yet to see the finale to the Brexit debacle, meaning the currency still rests on a shaky foundation going forward.

On the other end of the coin, the AUD is among the top five most volatile currencies in 2021. This has a lot to do with the Australia-China geopolitical tensions and trade disruptions due to the global pandemic.

Put together, the GBP and the AUD produce a forex pair capable of swings that could make a swing trader drool.

The bottom line

Volatility is hard to predict, but traders with the right tools and knowledge can anticipate it. When you reach such levels of expertise, you’ll realize that there are more currencies you can swing trade besides those discussed herein.