Happy Gold is among the many EAs being sold by Happy Forex. It has undergone many updates over the years. Its latest version is V2.0 for the MT4 platform and V2.1 for the MT5 terminal. The developers have not heaped praises on Happy Gold. They do not promise traders much in terms of what to expect while trading with the robot.

Product offering

The presentation of Happy Gold is divided into various sections. The main page describes the system’s pricing strategy, updates, minimal requirements, and features. There are also several links to live performances and backtest results. Other segments highlight the vendor’s other EAs, services, FAQ, blog, affiliates and a contact page.

As noted earlier, Happy Gold is a product of Happy Forex. Unfortunately, the official website does not disclose any information about this vendor. There is no data about the company’s location, contact details, the team it works with etc. So, we are dealing with an anonymous dealer. It will be very hard for traders to trust them especially now when they are treading carefully not to fall prey to online FX scams.

This system is not sold on its own. Instead, it comes as a full pack of 10EAs and is offered in 2 packages. The first option is priced at €299 and features 2 licenses while the second one is €499 and incorporates 5 licenses. When you buy the software, you will also get a complete tutorial, free updates and upgrade, 30-days money back guarantee and unlimited demo accounts.

Trading strategy

As far as the features go, the vendor says that the robot is 100% automated, is easy to install, auto-quotes detection 4 or 5 digits and supports ECN brokers. They also note that it mainly trades with the XAUUSD pair and does not apply martingale, hedging or grid strategies. The minimum recommended deposit is $100 and it works best on M15, M30 timeframes and H1/H4 charts.

Happy Gold applies the scalp or swing or grid news strategy. However, the vendor does not explain these strategies in detail. So, we are left to wonder if they are applied individually or simultaneously, and the kind of data the EA relies on to determine the strategy to use. A modified ZigZag indicator is also present. The indicator follows and links extreme points of the chart with the goal of finding trading opportunities.

Trading results

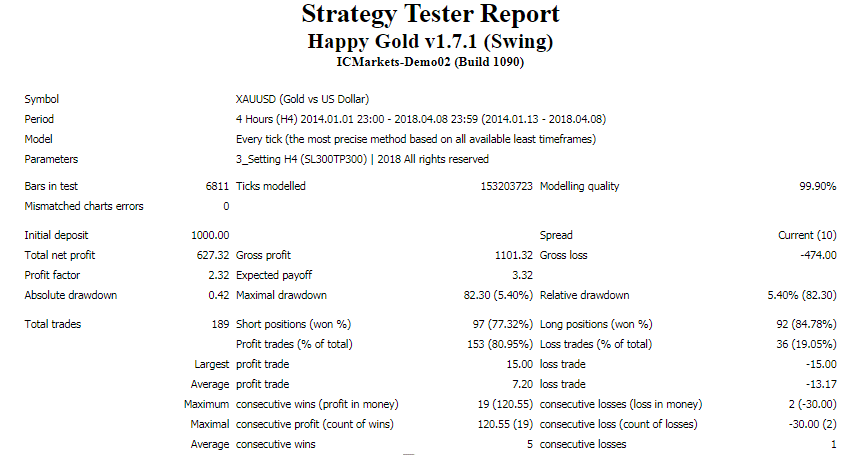

The EA operated this account from January 2014 to April 2018 using the 4 hour time frame. It performed a total 189 trades. The win rates for short positions were 77.32% and 84.78% for long ones. The average loss trade (-$13.17) was nearly 2 times higher than the average profit trade (-$7.20). Clearly, the account was highly likely to lose trades.

The initial deposit was $1000, and within a span of 4 years, the robot made a profit of $627.32. This is such a low amount. The profit factor was 2.32. The maximal drawdown was 5.40% and hence within acceptable levels.

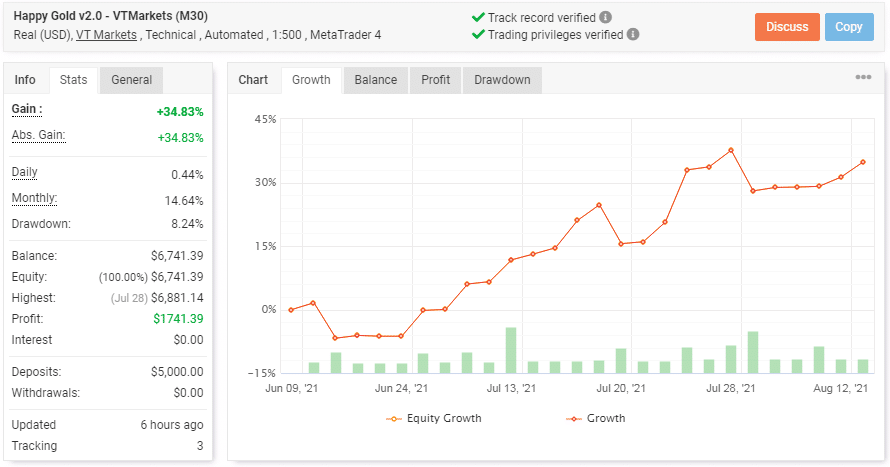

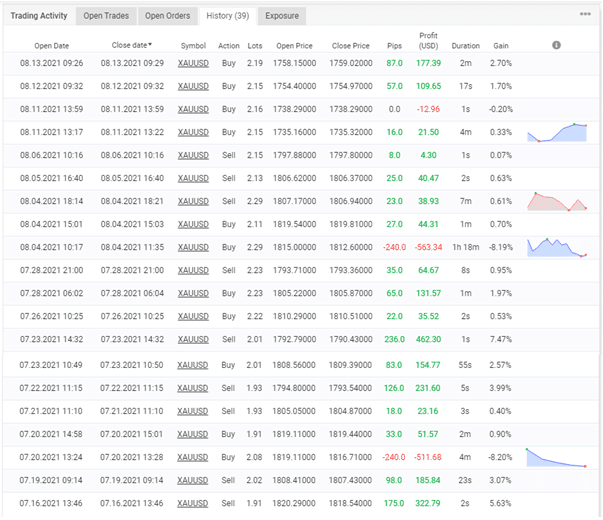

These are the real trading results of the newest version of Happy Gold v2.0. The robot operates under VT markets. The account was deposited at $5,000, and since its inception on June 9, 2021, it has grown this amount by 34.83%. This means that the profit made this far is $1741.39. The daily and monthly profits are 0.44% and 14.64% respectively. The drawdown which is 8.24% is slightly higher than the one in the backtest report. It appears the live market presents significant risks to the capital.

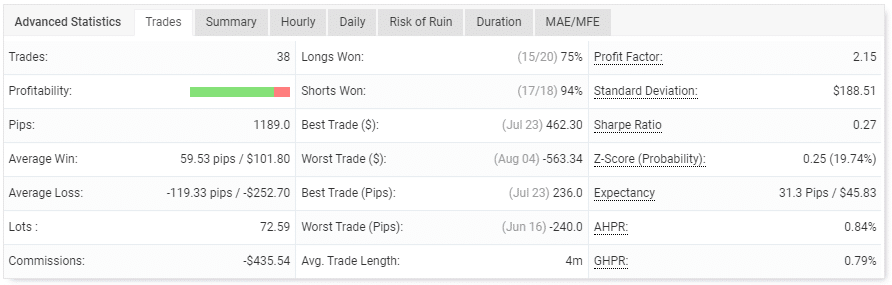

The EA has conducted 38 trades with 1189 pips. The average loss (-119.33 pips) is way higher than the average win (59.53 pips). In other words, the chances of making losses with the system are very high. The win rates for longs are 75% and 94% for shorts. The profit factor is 2.15. The number of lots traded is huge and this only exposes the account to more losses.

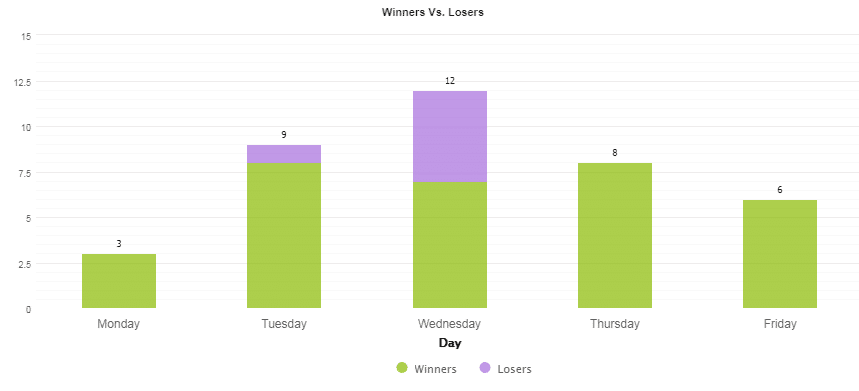

Many trades were conducted on Wednesday as it closed 12 deals.

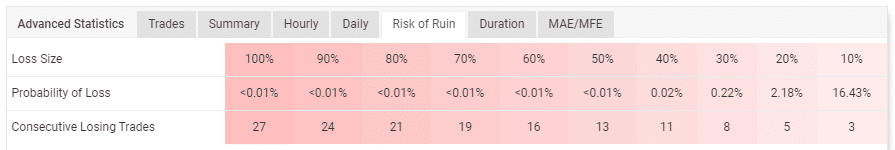

The risk of losing the account is sky-high. Losing 3 consecutive trades will cause 10% of the account to go under.

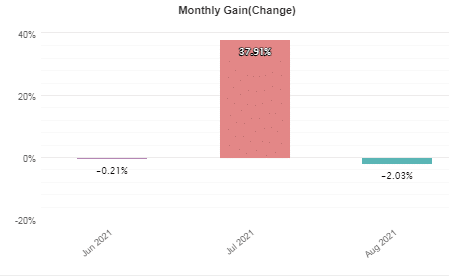

The account only made profits in July (37.91%). It has made losses amounting to -2.03% in August.

It is clear that the account traded with large lot sizes. The scalping strategy is evident as the robot traded with short time frames of between 1 second and 1 hour.

Customer reviews

Customer testimonials are not available on the robot’s official website. Such reviews are also missing on sites like Trustpilot, Forex Peace Army, Quora, and even mql5.