Stenvall Mark III is an FX Robot that practices a hybrid trading approach. It is the third generation EA of the original Stenvall Mark developed in 2016. As per the developer, this FX EA has provided 200% returns and a very low drawdown. The developer claims that it is apt for private investments for the long term or for creating trust management accounts.

Product offering

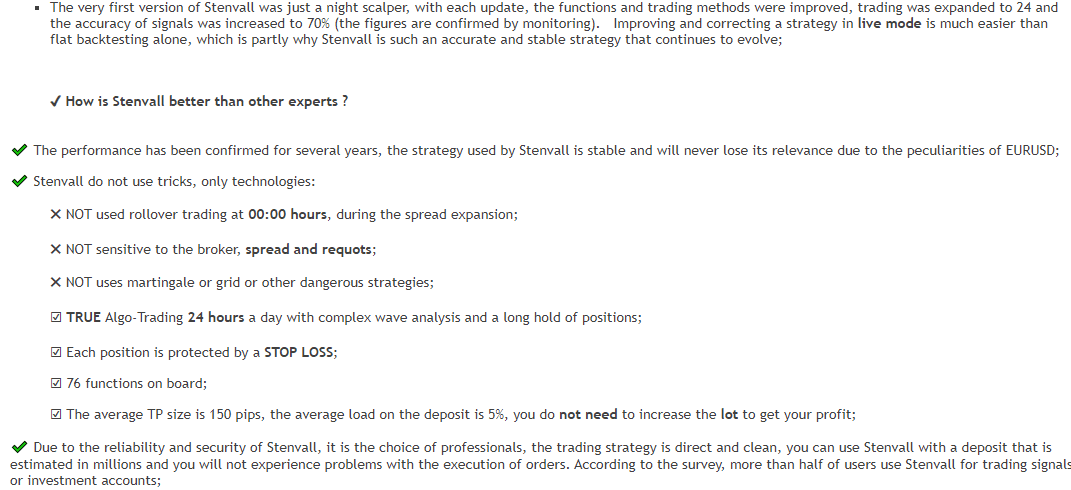

Gennady Sergienko is the developer of this ATS. He is located in Russia and has more than 5 years of experience in developing FX trading tools. He has 7 products and 2 signals to his credit. A telegram link and a website address are provided for support. Messaging via the MQL5 site is also an option. As per the vendor, this EA was first made available in 2019. It was initially created as a night scalper and later improvements in the functions and trading approach were made. He claims that it has reached 70% accuracy and that it uses a stable and precise approach that will continue to evolve.

Stenvall Mark III

| Type | Fully-automated EA |

| Price | $980 |

| Strategy | Trend, Counter-trend |

| Compatible Platforms | MT5 |

| Currency Pairs | EURUSD |

| Timeframe | M5 |

| Recommended Min. Deposit | N/A |

| Recommended Deposit | N/A |

| Leverage | N/A |

This EA is available for $980. A rental package is present that costs $399 per year. The product comes with a free demo. No info is present concerning the features available with the package. We could not find a refund offer for the product which makes us suspect its reliability. Further, compared to other similar products in the market, we find that EA is overpriced. Considering the lack of a refund offer and other downsides in the system we find it is not worth the money.

Trading strategy

This FX EA uses a mixture of trend and counter-trend approaches. The developer does not explain the approach used, instead claims that the strategy is stable and will be successful on the EURUSD pair despite the volatility of the pair.

The lack of explanation makes us doubt the reliability of the EA. It does not use rollover trading and dangerous methods like Martingale, Grid, and other such strategies. This MT5 tool uses the algorithmic method with a long hold position and intricate wave analysis. Each trade is safeguarded using an SL.

Trading results

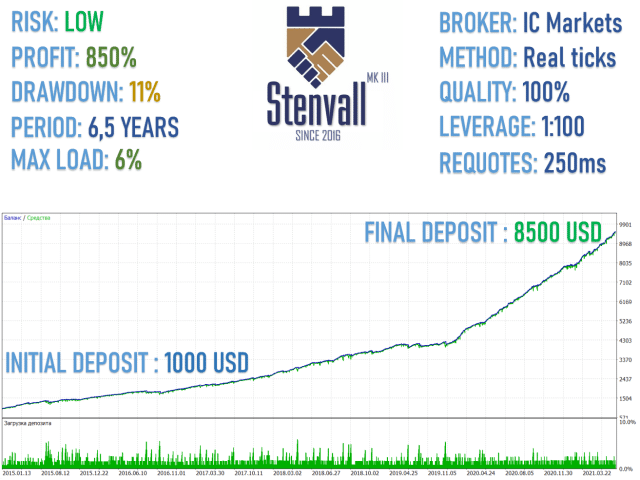

A backtesting result is provided on the MQL5 site. However, the developer does not provide a comprehensive report. From the details shown, it is clear that the system had generated a total profit of 850% for an initial deposit of $1000. The test was done with 100% modeling quality and using the ‘real ticks’ method. Leverage of 1:100 was used for the account.

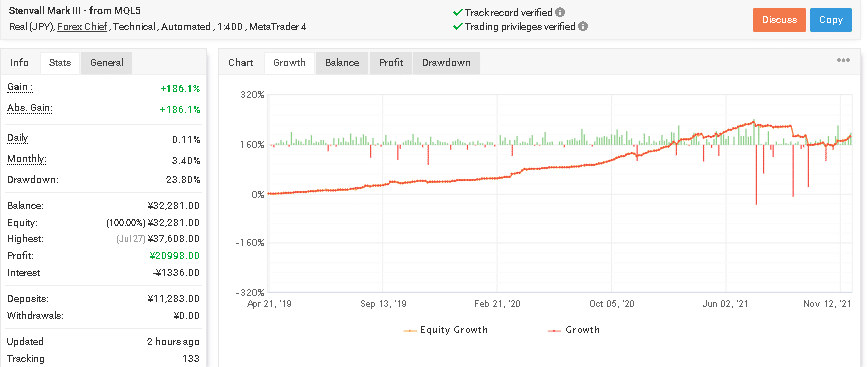

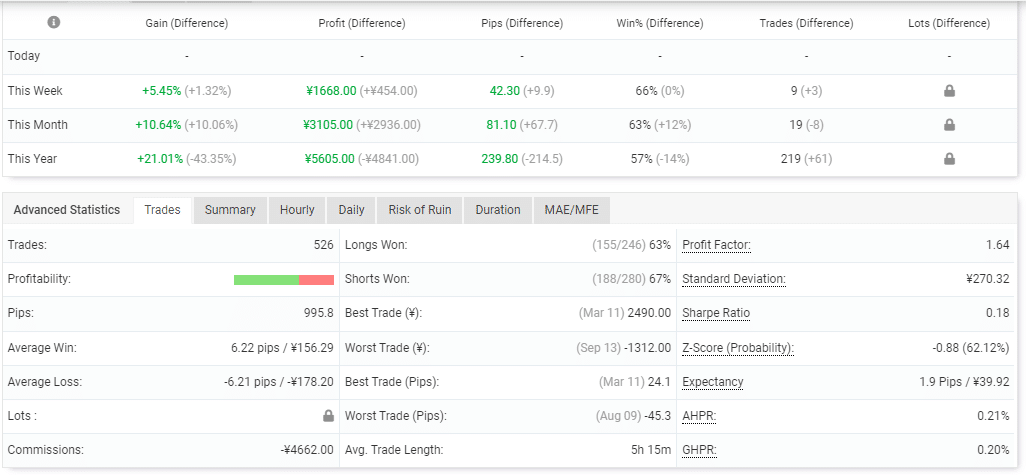

A real JPY account using the Forex Chief broker and the leverage of 1:400 on the MT4 platform verified by the myfxbook site is shown here.

A total profit of 186.1% and an absolute profit of similar value are present for the account. The daily and monthly profits are 0.11% and 3.40% respectively. A drawdown of 23.80% is present which shows a high-risk approach. The account that started with ¥11,283.00 in April 2019, has completed 526 trades with a profitability of 65% and a profit factor value of 1.64. We could not find the details of the lot sizes used for the trading as the info is hidden. The hidden data raises a red flag for this EA.

Customer reviews

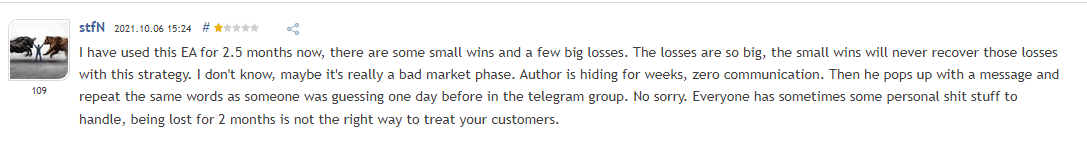

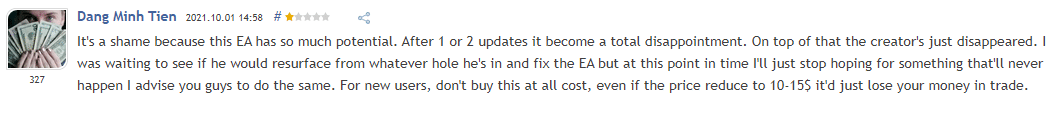

We found 20 reviews for this EA on the MQL5 site with a rating of 2.17/5. Here are a few of the recent feedback:

From the reviews, we can see that the system has resulted in big losses and the users recommend not to use the system as it can only end in losing your capital.