The use of robots in forex trading is getting more popular as more people get aware of how they work. While the number of traders using bots is relatively small, it is growing. Most of these people have been inspired by the success of algorithmic hedge funds like DE Shaw, Two Sigma, and Renaissance Technologies. In this article, we will look at some of the top forex pairs to use in automated trading.

Types of currency pairs

There are hundreds of currency pairs in existence today. These pairs are generally classified into three. First, we have major currencies. These are currency pairs made up of the US dollar and other developed country currencies. Examples of these pairs are USD/JPY, EUR/USD, and GBP/USD. These currencies are known for their high liquidity and relatively lower trading costs.

Second, there are minor currency pairs, which are made up of key developed country currencies. They are different from majors because they don’t have the US dollar. Examples of these currency crosses are EUR/JPY, EUR/CAD, and GBP/AUD. These crosses tend to be highly liquid, but their trading costs are relatively higher.

Finally, we have exotic currency pairs, which are made up of a combination of developed world currencies and of emerging market currencies. Some of these pairs are known for their high volatility and relatively high trading costs.

While these are the three main types of currency pairs, there is an additional one that tends to be irrelevant in the financial market. These are pairs that include developing country currencies like Tanzania, Ghana, and Kenya. Very few forex and CFD brokers provide these currency pairs.

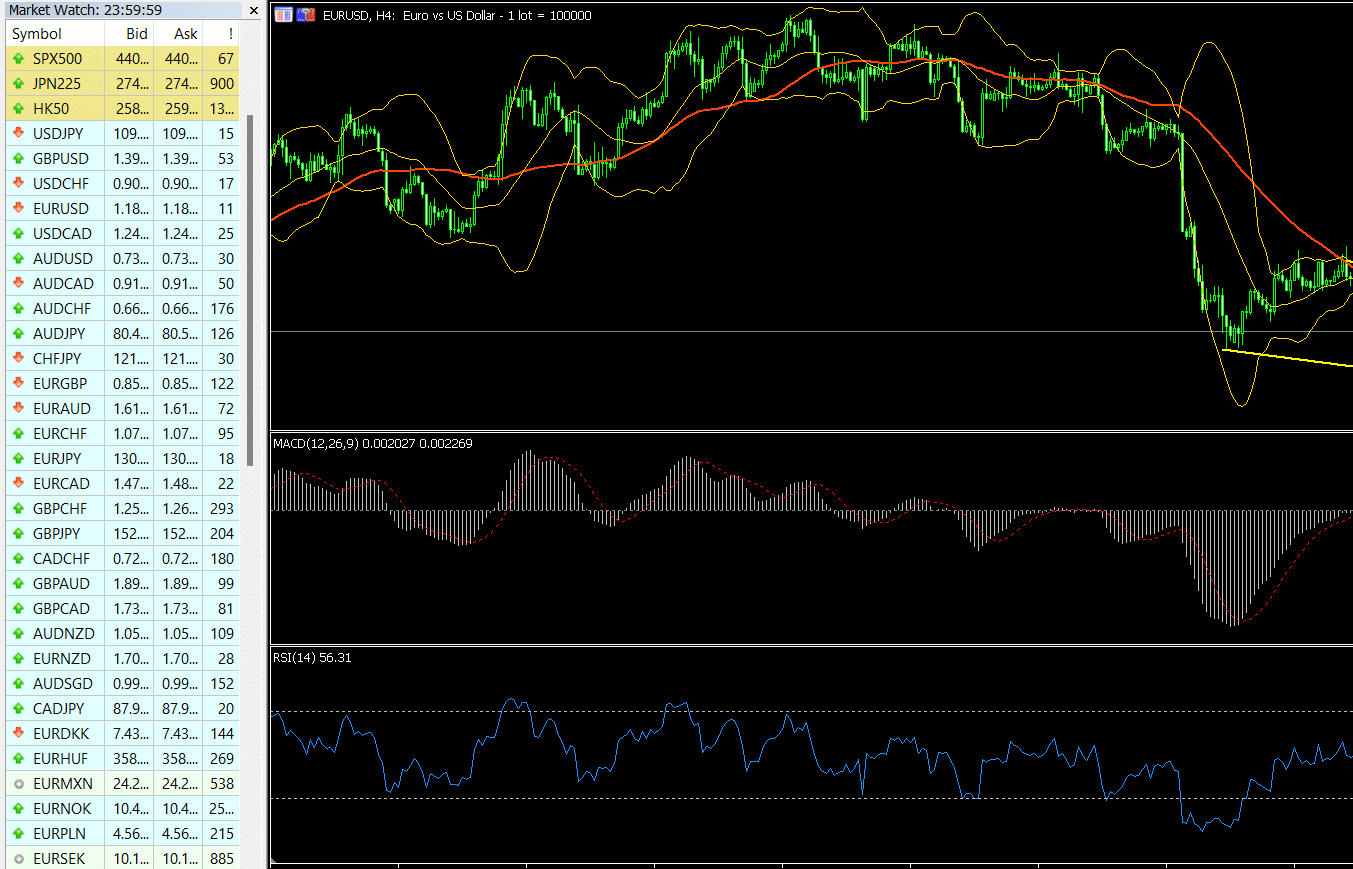

In the chart above, we see that the overall spread of key currency majors is substantially lower than that of key crosses. For example, the EUR/USD has a spread of 11 fractional pips, while the EUR/SEK has a spread of 885 (see the third column in the Market Watch window).

How forex robots work

Forex robots are tools built using code to automate the trading process or send signals when key market conditions come up. These tools are created using special programming languages like MQL 4 and 5 and Python. When used well, they can eradicate some human errors and identify key trading opportunities. These bots can be used across all asset classes like forex, commodities, and stocks.

Robots work because they are designed using key technical indicators. For example, if you are a trader who buys pairs when the Relative Strength Index (RSI) and Stochastic Oscillator moves to the oversold level, you can create a robot that will automatically open the trade when this happens.

Let us now look at the four best currency pairs to use with forex robots. This is because many pairs are not ideal for use with robots. For one, some pairs are relatively expensive to trade with. As shown above, some pairs have a spread of more than 800. Also, some pairs like the USD/HKD aren’t volatile since the Hong Kong dollar is pegged to the US dollar.

EUR/USD

The EUR/USD is the most liquid currency pair in the world because the two currencies are the most popular reserve currencies. Most forex brokers offer the pair with an average spread of less than ten fractional pips in most market conditions. This makes it a good pair to trade both manually and to use robots.

Another reason for its popularity is that the EU and US regularly publish critical economic data and that the ECB and the Federal Reserve are the most popular central banks in the world. For example, the US publishes its non-farm payrolls (NFP) data every first Friday of the month.

The Fed and ECB also meet eight times a year. As such, it is not uncommon to see the pair move more than 50 pips every day. Most importantly, the pair is offered by all forex and CFD brokers. Therefore, we recommend that you incorporate the pair in your algorithmic trading strategy.

GBP/USD

The British pound vs the US dollar is also a popular currency pair because of the close trading relationship between the US and the UK. New York and London are also the most important trading centers in the world. Like the EUR/USD, the GBP/USD is also one of the most affordable pairs to day trade. The pair is also provided by most forex and CFD brokers.

The GBP/USD is known for its substantial volatility because of the substantial amount of data from the US and the UK. The two countries regularly publish key data like employment, inflation, manufacturing, and retail sales every month. These numbers are important because they lead to heightened volatility across the currency pairs. This volatility is useful when you are using forex robots because it leads to more volatility.

AUD/USD

The Australian dollar vs US dollar is another popular currency pair among algo-traders. The pair is important for several reasons. For one, the Australian dollar is used as Australia’s currency and as a proxy for China and commodities. It is seen as a proxy for China because of the overall volume of goods that Australia sells to China. These goods include iron ore, copper, and coal.

The AUD/USD is a good pair for algorithmic traders because of its volatility, low cost, and the fact that it has several catalysts like commodity prices and China news.

USD/ZAR

The US dollar vs the South African rand is a popular currency pair among day traders because of its substantial volatility. This is because the rand is often viewed as a proxy for emerging markets. The rand is also associated with key commodities like gold, platinum, and palladium.

Further, the Reserve Bank of South Africa (SARB) is a popular emerging market central bank that meets regularly. Most importantly, South Africa is often targeted by rating agencies like Moody’s, Fitch, and S&P Global. This makes it a highly volatile currency pair, as shown above.

Summary

Not all currency pairs are ideal to use by algorithmic traders. In this article, we have looked at some of the most popular pairs you can use when you are using the automated strategy. We have based the list on currencies with substantial volatility and those that have relatively cheap trading costs. We have also looked at currency pairs that are provided by most forex brokers. Others that you can use are NZD/USD, USD/CAD, and USD/CHF.