Some people go into foreign exchange trading for fun, but they elect to turn the activity into a career after cutting their teeth. But whether you reach such a level or not, you will inevitably learn a great deal about forex trading.

There is a lot to learn in forex, including market research, risk management, and trading strategies. A great example of an approach you could use is day trading. We will discuss day trading in this article and outline the best forex pairs for this approach.

What you should know about day trading

A defining quality of the forex market is volatility, where prices regularly fluctuate due to demand and supply forces. In a conventional market, such a scenario would be worrying because of elevated risk.

In fact, there is a category of traders who thrive in a fast-moving market, where price gyrations are beyond what a novice could handle. They are day traders. In other words, day trading involves the buying and selling of one or two currency pairs multiple times in a single day. In addition, traders prefer short-selling a currency pair several times a day.

The hope is that the more you make the trades, the more you capitalize on small increases the currency pair makes during the day. Thus, for each trade, you aim to gain tiny profit margins but in a short period, then move on to the next one.

Financial Industry Regulatory Authority (FINRA), a US-based entity, classifies those who trade four or more times in five business days as pattern day traders. Your day-trading activities must be greater than 6% of total trading activity for the same period to qualify under this category. In addition, the regulator imposes a minimum equity limit of $25,000 for day traders.

To be sure, day trading is an exacting endeavor. Therefore, you should be able to allocate substantial time and money. For instance, you need several hours to research and plan your strategy before making trades. Also, it would help if you also had an appropriate exit strategy on hand before the end of the trading day.

According to experts, day trading is as engaging as a full-time job. In other words, the trading strategy is not for the faint-hearted. You need patience, emotional stability, and, most critically, discipline.

Day trading is more prevalent in the equities market, but forex traders also use it a lot. Below, we outline the best currency pairs for day trading.

It is worth noting that an ideal currency pair for day trading must be liquid. If you may recall, we mentioned that this strategy thrives in a volatile market, where price action is intense.

EURUSD: Euro vs. US dollar

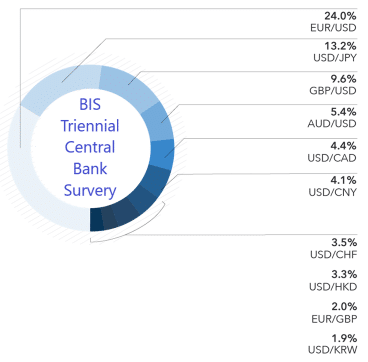

From the most recent Bank of International Settlements (BIS) triennial survey (as of 16 September 2019), the EURUSD pair accounts for 24% of the foreign exchange market liquidity. The next pair is USDJPY, accounting for roughly 13% of the liquidity.

Specifically, the EURUSD is a famous currency pair because each of the currencies is backed by two of the world’s strongest economies. As per the latest figures, the US accounts for 24% of global GDP against roughly 15% for the European Union single market.

Also, the currencies are in high demand as reserves for other economies. This ensures lots of liquidity for the pair and tight spreads.

But one might argue that the EURUSD pair lacks the necessary volatility to satisfy day traders because of the relative stability of major currency pairs or majors. There is truth in such an argument, mainly when one focuses entirely on volatility.

However, day traders must close positions within the same day, meaning they need currency pairs with ready buyers or takers. This is where the EURUSD’s liquidity factor comes in.

GBPUSD: Sterling pound vs. US dollar

GBPUSD also scores favorably regarding liquidity, where it ranks third in the BIS triennial survey.

Historically, the GBPUSD pair has been the most stable forex pair owing to the strength of the underlying economies. But over the past five years, the pair has exhibited unusually high volatility levels.

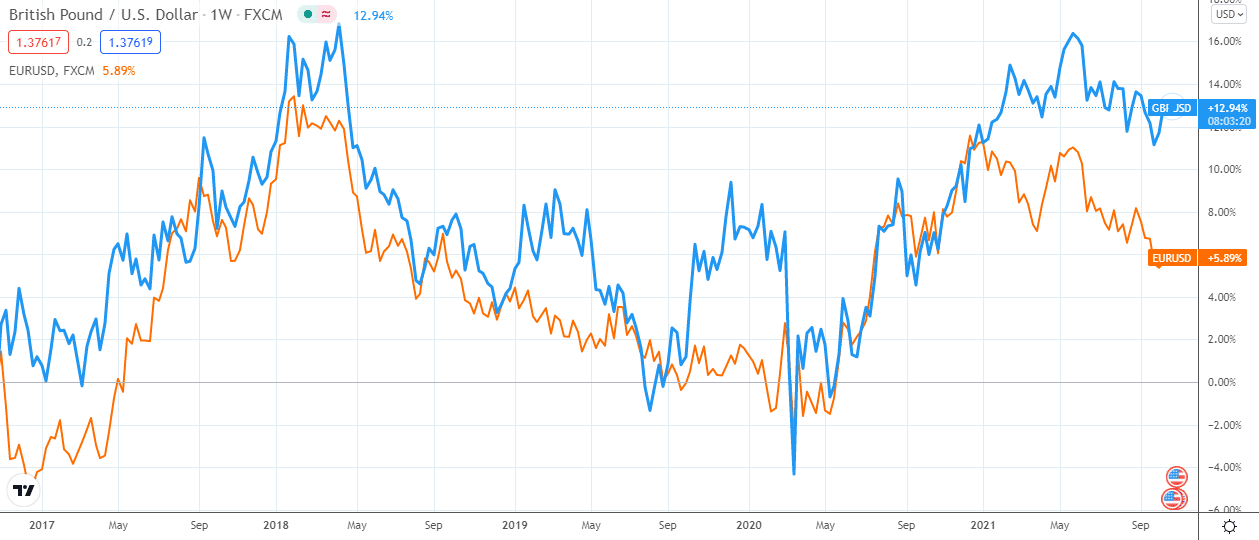

Since Brits voted to exit the EU, there has been lots of uncertainty about the UK economy. The precariousness carried into forex and injected lots of volatility in the GBPUSD market. For context, the chart below compares the price action for GBPUSD (blue line) and EURUSD (orange line) since the Brexit vote.

The EURUSD pair appears smoother than the GBPUSD. Remarkably, most of the volatility appeared between 2019 and 2020 when the UK and the EU were negotiating the Brexit deal.

Although the pair is stabilizing, it remains a favorite for day traders for another critical reason – it has tight spreads.

Australian dollar vs. Japanese yen (AUDJPY)

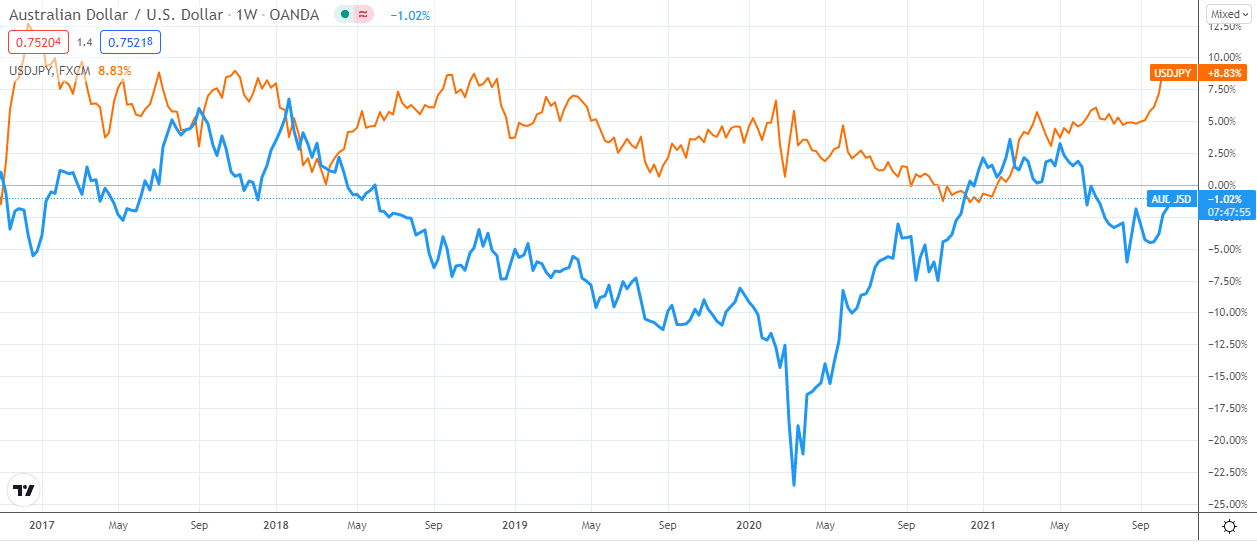

AUDJPY is an exciting pair. On the one hand, the AUD responds positively to risk-on sentiment. It means its demand rises when risk appetite in the market grows.

On the other hand, the JPY is traditionally a safe haven. As a result, more traders buy the currency when global markets turn choppy. In other words, the AUD and the JPY have an inverse relationship; see the chart below:

In a typical day, market sentiment oscillates from positive to negative severally. This happens in response to news items hitting the headlines at different times of the day. Thus, the pair usually exhibits high volatility levels.

Final thoughts

Day trading is a high-stakes approach where only those with sufficient skill and fortitude can survive. If you’re thinking about joining the class of traders, ensure you have enough experience and knowledge of the market. Also, allocate sufficient capital to absorb sudden turns without a margin call. Most importantly, develop and perfect trading strategies using practice accounts.