Gone are the days when life as a forex trader meant spending endless hours scouring charts for trade signals. Nowadays, there are specialized programs that automate the whole technical analysis process, saving the trader all that time and effort. These programs are called forex robots or expert advisers (EAs). Other than performing technical analysis, EAs are also capable of executing trades on your behalf. With one of those, all you’ll need to do is define your trading strategy, and they’ll find ideal trades in accordance with your trading strategy.

The New York trading session

The forex market runs 24 hours a day, Mondays through Fridays. During the trading day, different trading desks around the world will be active during different times of the day. Depending on the individual, traders will often trade the sessions that best favor their trading style. In New York, this market runs from 8:00 AM to 5:00 PM local time. This is equivalent to noon to 8:00 PM GMT.

The European market’s active hours directly precede the New York session. As a matter of fact, these two sessions overlap from 12:00 PM to 4:00 PM GMT. These are the two biggest hubs for trading forex. For that reason, this overlap sees the biggest trading volume, as well as the highest volatility and liquidity. This is caused by a large number of active market participants.

Due to the overlap, the beginning of the US session will see more volatility than towards its close. Most traders prefer trading this session because the increased volatility and liquidity translate to much lower spreads. By minimizing transaction costs, they can ultimately increase their profit margins. Besides, the increased volatility presents significant price moves which traders can take advantage of for profit.

Choosing currency pairs to trade

The good news is, during the US session, most currencies will experience increased volatility, whether major, minor or exotic crosses. A common misconception among traders is that one must trade the pairs corresponding to the active session. For instance, only AUD, JPY, and NZD pairs can be traded during the Tokyo session, GBP, EUR, and CHF in the London session, while the US session is reserved for USD and CAD crosses.

Well, there is some level of truth to this, as such currencies may record the largest moves during their corresponding sessions, especially after significant news releases from their respective countries. However, that’s not always the case. You can trade other currencies apart from North American currencies in the New York session, depending on their market circumstances.

Because of the increased volatility synonymous with this session, traders will often be looking to trade breakouts from previously held levels of support or resistance. Breakouts from support imply the need to open short trades, while those from resistances compel traders to open long trades.

How to trade breakouts

There are two types of breakouts – an upward breakout from resistance and a downward breakout from support. More often than not, the latter will happen when it is preceded by a bearish trend, while the former happens when the prevalent trend is bullish. Let’s look at how to trade each of these.

Bullish breakout

- Mark the beginning and end of the NY session on the chart using vertical lines.

- Check for a pair that was in an uptrend before the New York open.

- Prices must have been held below a valid resistance level prior to the beginning of this session.

- Wait for the upward breakout during the NY session.

- When it happens, wait for another candle to close above the breakout line.

- Enter a buy trade at this point.

- Place your stop-loss just below the breakout line.

- Place your profit target at the next valid level of resistance.

Downward breakout

- Look for a pair in a strong downtrend before the New York open.

- Prices must have been held above a valid support level before 12:00 PM GMT.

- Look out for the downward breakout during the NY session.

- Wait for another candle to close below this support.

- When it does, open a short trade and place your stop loss above the broken line of support.

- Place your profit target at the next valid support level.

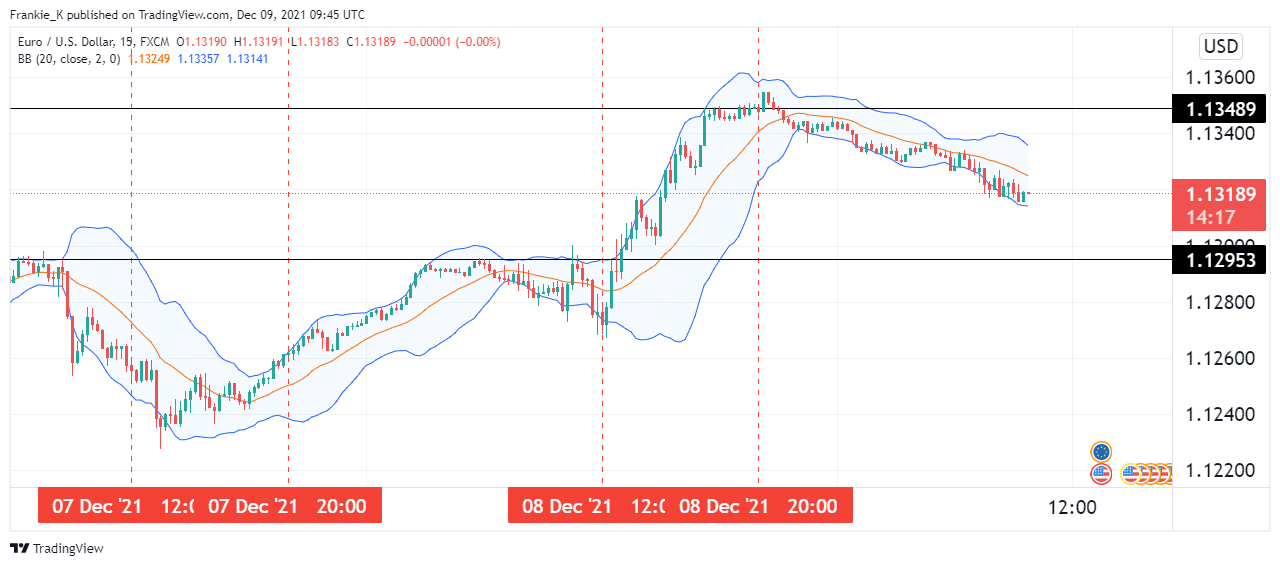

The example above shows an upward breakout from the resistance during the New York session. For signal confirmation, we employed the Bollinger bands indicator. On 8th December, we observed prices being on a rally before the NY open. Just before the open, they consolidated as the resistance at 1.12953 held. Soon after the open, they crossed above Bollinger band’s middle band and went ahead to break out of resistance. This gave our entry for a long trade. The profit target was placed at the next valid resistance, which was hit just before the New York markets closed.

Adjusting your EA to trade NY session breakouts

The first instruction you will be giving your EA is to limit its trade entry hours from 12:00 PM to 8:00 PM GMT. Next, you will have it look for valid resistance or support levels close to the price at the New York open. For long trades, set a condition that if the middle Bollinger band is crossed and prices break out of resistance, the EA should open long trade. Stop losses should be at the middle Bollinger band, while take profits should be at the next valid resistance point.

For downward breakouts, it’s the opposite. Entry should be when the middle Bollinger band is crossed, and the support level is broken out. Stop-loss should be at the aforementioned middle band, while the take profit should be at the next valid support level.

Conclusion

The New York session is characterized by high volatility and liquidity. For that reason, traders often lookout for breakouts as they present the largest profit potential. When adjusting your robot to trade this session, you should define a breakout strategy for it to follow.