A trader can use a variety of tools to aid in the entire decision-making process, depending on the specific purpose. The majority of traders are familiar with momentum indicators like the Relative Strength Index. Other types of indicators, on the other hand, are based on volume, volatility, cycles, or some other measure. One of the volatility-based tools is the ATR. J. Welles Wilder Jr., a well-known technical analyst, first proposed the indicator in his 1978 book “New Concepts in Technical Trading Systems.” It was originally only used in commodities markets, but it is now employed in a wide range of markets, including FX, stocks, indices.

Introduction

Average True Range is a single-line volatility tool. Volatility refers to the pace at which the price fluctuates in relation to the average, whereas momentum refers to the rate at which the price changes in a specific direction. Volatile markets have broad price ranges, whereas less volatile markets have narrower price ranges.

The ATR was created just to quantify volatility, and it does not reflect trend direction or momentum. Such indicators assess the degree of volatility in a currency pair and assist traders in predicting when the price of the underlying currency pair is going to become more or less volatile.

Calculation and interpretation

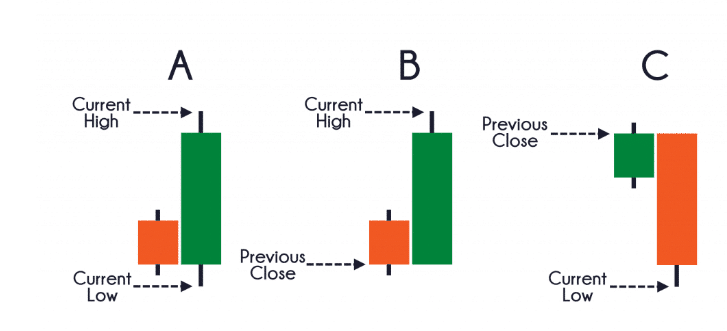

Before you can compute an Average True Range, you must first create a series of true ranges based on past pricing data. By calculating the following and finding the greatest sum, you can determine the true range of a given period:

- Taking the current high and subtracting the previous close

- Taking the current low and subtracting the previous close

- Taking the current high and subtracting the current low

Following the calculation of the three true ranges, you may proceed to the ATR formula.

ATR = (previous ATR x (n-1) + TR) / n

Where:

N-number of periods. 14 or 20 is commonly used.

TR – true range

A greater ‘n’ indicates a slower measure of volatility, whereas a smaller ‘n’ indicates a faster measure of volatility.

Interpretation

It’s easy to figure out what the ATR indicator readings mean. When the ATR line rises, it indicates that the underlying asset’s volatility is rising; conversely, when the ATR line falls, it indicates that the underlying asset’s volatility is falling. Markets fluctuate between periods of high and low volatility, and ATR may assist traders in keeping track of these shifts.

Understanding volatility might aid traders in determining move targets. For example, if the ATR for the GBPUSD pair is 80 pips over the past seven time periods, a price objective of fewer than 80 pips is more likely to be met during the current trading session.

How to utilize ATR indicator

Position sizing

You should set the correct number of units to buy or sell a currency pair, employing position sizing techniques. It is one of the most important skills a forex trader can have. Using the optimal lot size on different currency pairings may significantly decrease risk exposure and improve trading effectiveness in the market. High volatility currencies should be traded with smaller lot sizes as a rule of thumb, whereas low volatility currencies can be traded with larger lot sizes.

Traders may trade currencies with higher ATR values, such as the AUDJPY, AUDUSD, and CADJPY, with smaller lot sizes, while currencies with lower ATR values, such as the EURCHF, AUDCHF, and EURCAD pair, can be traded with bigger lot sizes.

Identifying breakouts

When trading financial assets, breakouts provide some of the best trading possibilities. A breakout occurs when a currency’s price rises above a resistance level or falls below a support level. Breakouts signal the possibility of a price moving in the breakout direction. The ATR will show low values when the price consolidates, indicating a low volatility market. Breakouts, which occur with considerable volatility, always follow periods of market consolidation.

The ATR assists traders in accurately timing these breakouts and allows them to participate in the new trend from the start. A rise in the ATR after a period of low or flat readings indicates increased market volatility, and traders should plan how to trade the resulting breakout accordingly.

Identifying buy and sell entires

The ATR is only a volatility gauge, and it will not give ideal entry points in a moving market. Traders can correct this by overlaying a signal line on top of the ATR. Traders can, for example, overlay a 20-period SMA over the ATR and keep an eye out for crossovers. An ATR cross above the signal line confirms an uptrend when prices are trending upward, allowing traders to place aggressive buy orders in the market. When prices drop, an ATR crossing below the signal line confirms a downtrend, allowing traders to sell orders in the market.

Trailing stop loss

A trailing stop loss allows you to exit a trade if the currency pair price goes against you while also allowing you to adjust the stop loss if the price moves in your favor. Many day traders employ the ATR to determine where their trailing stop loss should be placed.

Examine the current ATR reading at the time of a trade. To find an appropriate stop loss point, multiply the ATR by two. If you’re buying a currency, place a stop loss twice the ATR level below the entry price.

If you’re long and the price moves in your favor, keep your stop loss at twice the ATR below the current price. The stop loss only moves up in this circumstance, not down. Once it is raised up, it remains there until it can be moved up again or the trade is closed due to the price going below the following stop loss level. Short trades follow the identical procedure; only the stop loss moves down.

Conclusion

The ATR is a price volatility indicator that was originally created for commodity trading. The tool is made up of a single line that moves in a range. It can be calculated, and it’s found in a lot of charting software. It can be used to identify breakouts, set position size, buy and sell orders, and trailing stop losses.