Like many other activities, buying and selling of currencies require carefully planned and executed strategies. Thankfully, a foreign exchange (forex) trader has many options when choosing the best trading strategy.

The primary objective of a forex trading strategy is to enable a trader to take positions in the market on the back of accurate insight, positions that would generate meaningful profit. Some of the strategies could be familiar to you, including position trading, day trading and swing trading, and scalping.

Today we will talk about scalping and list three currency pairs best suited for this trading approach.

Let’s talk about forex scalping

The Merriam-Webster dictionary defines the verb “to scalp” as removing an upper part from something. Thus, it suggests removing the upper thinner layer of, for example, the human head’s integument.

If we extrapolate the definition into forex trading, scalping refers to shaving off small amounts of pips from the market per trade as many times as possible.

However, the more universally accepted definition is the buying and selling currency pairs where the trader holds short-term positions. Some positions can last for a few seconds such that one can capture multiple price movements.

Because of the short periods between opening and closing of a position, scalping is often fast-paced. Usually, traders want to open and close as many positions as possible to collect more frequent profits.

In other words, one can view scalping as a trading approach built around the principle of accumulation. The idea is to collect a small number of pips per trade many times in a day such that one ends up with a substantial income after summing up the wins.

What makes scalping attractive?

A quick side note; scalping is not a trading strategy in itself. Instead, it is a general approach to forex where traders employ specific tools, including the Stochastic Oscillator, Moving Average, RSI, Parabolic SAR indicator, etc.

Generally, scalping is attractive because of its focus on smaller moves in the market. At this juncture, it is worth noting that this approach to forex trading often focuses heavily on price action. It means traders only focus on the technical analysis aspect of market research. Primarily, this is why you will see scalping strategies often taking the names of indicators, such as the RSI strategy.

But to profit from smaller moves, which happen more frequently, should not fool you into thinking scalping is easy. On the contrary, scalping could be taxing because you have a small window to make good trades using insights from a hurriedly done technical analysis. In other words, success is only possible if you can think quickly and focus intensely for long hours.

The downsides aside, scalping is one of the most popular trading techniques. However, it takes time and experience to attune your mind to the ins and outs of the approach.

Sometimes, the details of scalping alone are unhelpful. Anyone can gather information on the trading strategy, but success will come only to the few who can see beyond the nuts and bolts. For example, do you know what currency pairs are ideal for scalp trading?

Best currency pairs for scalping

Before we go into the details of scalping, it helps to note the following:

- Scalping is a high-frequency trading approach, meaning the ideal currency pair must achieve a high volume at least once in a 24-hour trading cycle.

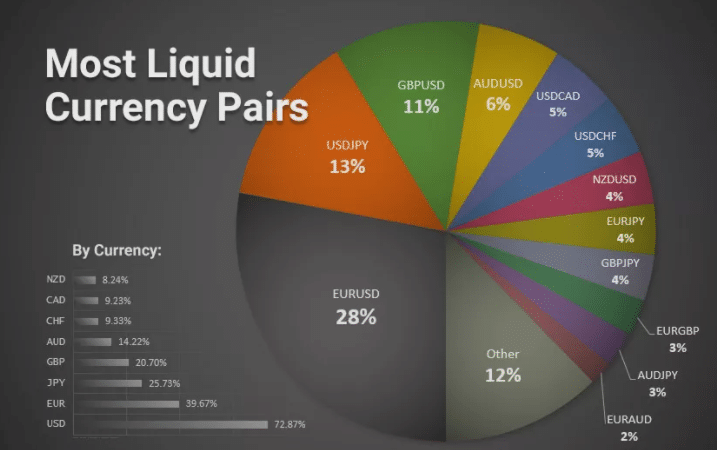

- The currency pair must also be among the most liquid. High liquidity enables the currency pair to offer tighter spreads, allowing you to open and close positions quickly.

EURUSD

The EURUSD was the most liquid currency pair as of January 2021, claiming 28% of the market.

Moreover, the EURUSD pair is the leader of the “majors” club – pairs consisting of currencies from dominant and most powerful economies worldwide. Majors connote responsiveness to market shocks, a high volume, and liquidity.

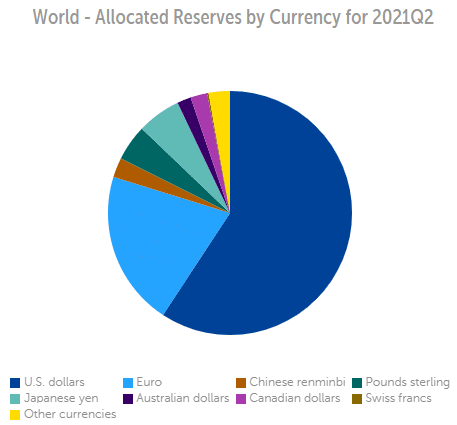

The euro and the US dollar also top the charts regarding the share of global foreign exchange reserves. According to the latest Currency Composition of Official Foreign Exchange Reserves (COFER) data, claims in USD stand at 59.23%. On the other hand, the euro’s share of COFER comes second at 20.54%.

The dominance of the constituent currencies also makes the EURUSD the pair that most banks worldwide trade.

However, the stability of the corresponding economies may, sometimes, cause the currency pair to move slowly in the market. In such cases, scalpers can only generate conservative returns.

USDJPY

Scalpers love the USDJPY primarily because of the substantial interest rate differential. For instance, the Bank of Japan’s latest interest decision is -0.10% (as of 15 July 2021) and 0.25% (as of 22 September 2021) for the US Fed. This is why sometimes traders refer to the USDJPY as a carry pair.

A carry pair is often liquid because of global demand and high volatility. But the volatility levels could get too far out of hand and could sink your capital unless you implement prudent risk management techniques.

GBPUSD

Often called “the cable,” the currency pair is a favorite for many scalpers. The most convincing case for the pair is the deep integration of the US and UK economies.

Additionally, the Bank of England and the US Fed are leading central banks and score favorably regarding independence and accountability. Most importantly, commercial banks between the two economies trade high volumes of currency every single day.

Furthermore, scalpers love the cable for the fact that the GBP is reasonably stronger than the greenback. The significant difference in the USD and the GBP value favors scalpers, where chances for generating a meaningful income are higher.

Lastly, the GBP market has been very uncertain since Brexit. The uncertainty deepened when the Brexit negotiations indicated the relationship between Europe and the UK is unpredictable at the moment. For this reason, there is long-term volatility in the GBP market, which makes the GBPUSD pair an ideal choice for scalping.

Conclusion

Great traders, like water, find their level. Scalping is a popular strategy among expert traders, but it behooves you to make sure the approach fits your personality. For example, the strategy would be apt if you like fast trading and can spend many hours staring at charts.